6 questions you should be asking your mortgage...

So you’ve decided to get your mortgage with a broker, maybe after reading about the savings you could get by shopping from multiple lenders and choosing from the best mortgage offers. If you plan...

So you’ve decided to get your mortgage with a broker, maybe after reading about the savings you could get by shopping from multiple lenders and choosing from the best mortgage offers. If you plan...

So you’ve decided to go with a mortgage brokerage and all the advantages it has over a bank. Maybe you just read our article (link when the article is live) going into the differences between a...

Subscribe to receive Perch’s monthly Canada interest forecast newsletter (once a month only!) You will receive an email after you submit this form to finalize your newsletter subscription. *...

So, if we aren’t already in a recession, economists admit that we’ll definitely see one in 2023. That means layoffs, asset depreciation, and tighter household budgets for Canadians. The biggest...

What type of documents do I need for proof of income when getting a mortgage? If you’re looking to get a mortgage, inevitably you will need to provide proof of your income. This is easier for some...

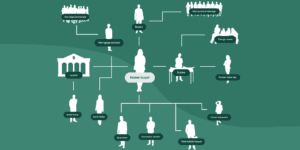

If you don’t know the difference between getting a mortgage with the bank or getting a mortgage with a mortgage broker, then this article is for you. In short, banks act as lenders, directly...

If you’re a beginner shopping for a mortgage, you’ve probably heard that you can go with a bank or with a mortgage broker, but what’s the difference? In this article we’re going to go...

Most of us don’t deal with bank drafts on a regular basis. So if you’re not familiar with what they are or how it works, we’re here to get you sorted. Protip: If you need to move around a large...

First of all, what is mortgage default insurance? Mortgage default insurance (also known as mortgage loan insurance, or simply mortgage insurance) was put in place to help Canadian home buyers...

What to expect when going with an alternative lender If you’re a beginner to the mortgage world, you may be surprised to learn that not

As the saying goes, “Nothing can be said to be certain, except death and taxes.” When it comes to buying a new home, you might

So you’ve decided to purchase a home and it’s time to start thinking about the finances. Chances are you’ve probably heard of getting a mortgage

If it’s your first time buying a home, it can be intimidating figuring out all the different agents and lawyers you need to talk to

Subscribe to receive Perch’s monthly Canada interest forecast newsletter (once a month only!) You will receive an email after you submit this form to finalize

Are you planning a move soon? If so, have you considered your options when it comes to your Internet provider? In the case that you

In most cases, when you buy a house with a mortgage, whether it’s through a bank, a credit union, or a private lender, the lender

What is a mortgage assumption? A mortgage assumption is when you sell your home to a buyer and transfer your mortgage to them as well.

You’ve been approved for a mortgage, congratulations! Then the unthinkable happens: your appraisal condition cannot be satisfied because the value came in lower than expected.

What should you look for in a mortgage? Whether you’re looking for a new home, or you’re an existing homeowner, shopping for a mortgage isn’t