Burlington, Ontario real estate market outlook 2023

We sat down with our realtor partner Matthew Prior to give us an outlook on the Burlington / Oakville real estate market for 2023.

How has the Burlington real estate market done in 2022?

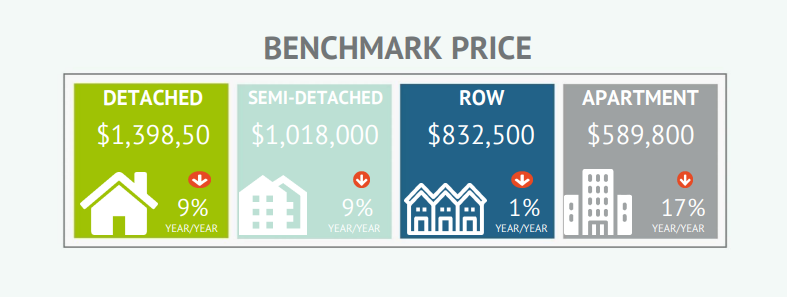

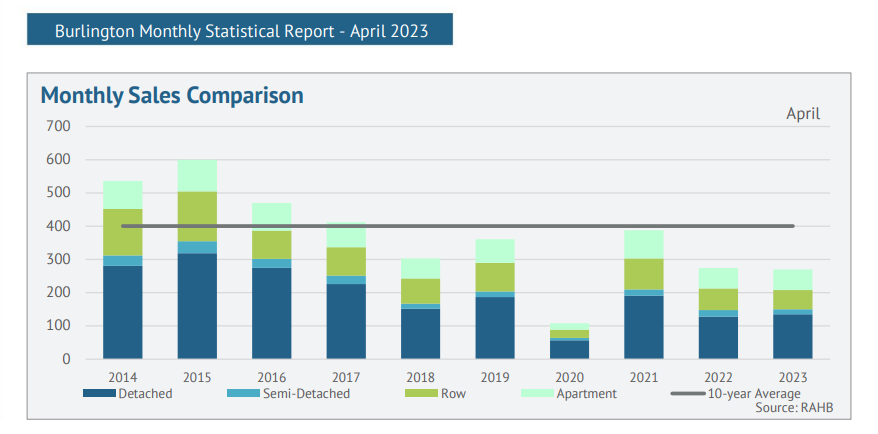

The Burlington market has experienced significant fluctuations in the past year due to the Bank of Canada’s (BoC) interest rate hikes. This led to a decline of both the number of listings on the market & buyers in the market (supply & demand), which in turn drove prices downward as a cautious “wait & see approach” was employed by most. After a record-breaking Spring 2022, we saw a seasonal dip through the Summer, and a plateauing/balancing effect into the Fall/Winter. With the warmer weather of Spring 2023 arriving, the market has heated up.

How has the market responded to the rate hikes from the Bank of Canada?

As one would expect when the cost of borrowing was on the rise, it forced downward pressure on affordability and buyers were no longer interested in “competing” for properties. Overall buyer sentiment quickly shifted from a ‘fear of missing out’ mentality, to apprehensive buyers & reluctant sellers (no longer being able to achieve selling prices that their neighbours had garnered). With the BoC holding rates steady this spring, consumer confidence seemingly returned with a vengeance, albeit sellers are often 2 steps behind buyers, and the traditional listing inventory that we see during the Spring has been tamped down by hesitant sellers. Most are wondering “if I sell my home, where do I move?”

What factors do you see impacting the market?

In recent weeks/months, limited inventory (over 30% less “new listings” hitting the market than the 5 year average for April, inclusive of extremely low figures during the 2020 pandemic lockdown) has driven competition in many segments of the market. Thus, prices have been on the rise for consecutive months. Some “move-in-ready” home values are now seeing prices matching/surpassing that of the peak last Spring. For years we’ve talked about low inventory levels, and immigration into the urban centres (such as Toronto and it’s suburbs) has created a vicious demand for housing. As such, the rental market has taken off, and some consumers are now considering whether it makes more sense to jump into ownership as opposed to continuing to rent.

Where do you see the market going in the future?

I’m hopeful that we’ll start to see a plateau as sellers start to sell at the fair market values that they thought they had missed out on, having not sold last Spring. The next few months will likely see a bit of a slowdown due to traditional summer vacations while kids are out of school, but so long as there isn’t a global economic downturn in the meantime, I would anticipate we’ll see an increase in the number of listings this Fall. This could be a welcome reprieve from the bidding wars, and perhaps allow for buyers to do a little more due diligence and base their offers upon similar comparable sales, instead of having to guess how eager/desperate other buyers are in competition. In the long term (3+ years), the GTA & suburban market is traditionally always trending towards appreciation in home values.

What advice would you give to someone thinking about buying in Burlington?

My best advice would be to align yourself with an agent who will take the time to educate you on both what buyers & sellers are experiencing from week to week/month to month, and arm yourself with a mortgage broker who is also keeping an eye on fluctuating rates. Do your due diligence in advance, so you’re prepared as to what you can comfortably afford (monthly budgeting) and set a “walk away” price for any specific property. Whereby you won’t be disappointed if someone else is willing to “win” that home by paying a little more. I’m always available to chat and explain the nuances of the weekly changing market for my clients.

Thanks to Matthew for answering these questions and giving us insight into the Burlington market.

If you're looking to buy in the Burlington region you can reach Matthew here:

(289)937-1449

Check out our interest rate forecast for an up to date outlook on the mortgage market, including where our analysts predict rates will go over the next 5 years.