Mortgages, simplified

Buy the right property sooner, find your mortgage and build wealth through real estate.

Calculators and tools:

- See what you can afford now or in the future

- Get connected to local, recommended realtors

- Detailed checklists, alerts and reminders

- Learn more →

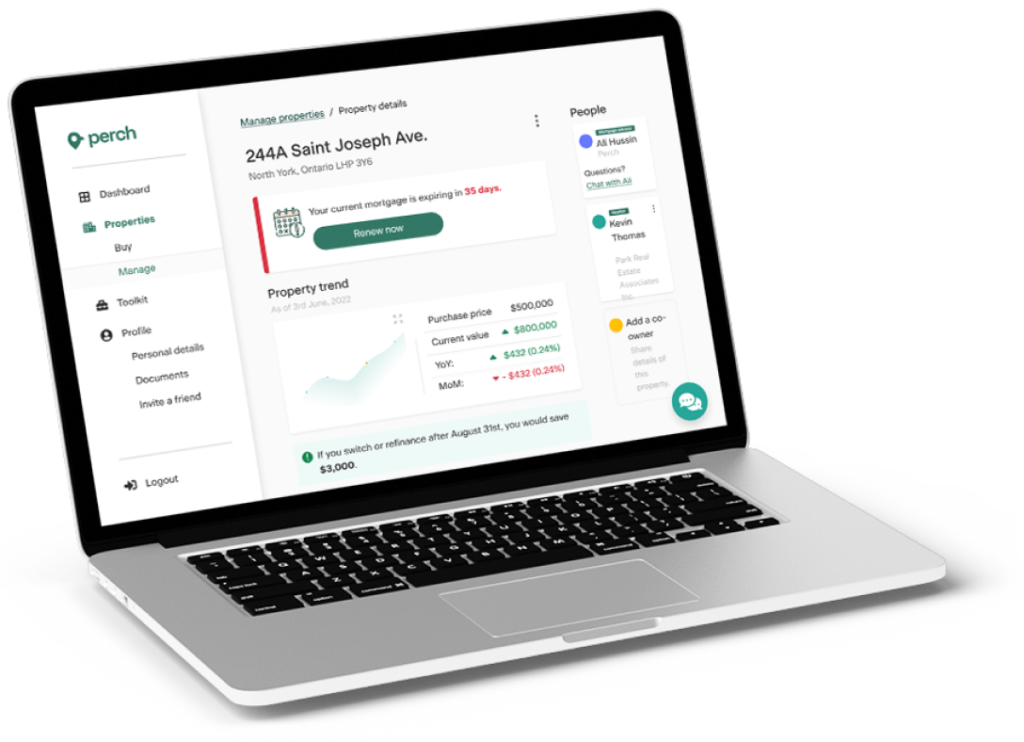

- Track growth with monthly property value estimates

- Unlock mortgage insights, like when to switch or renew

- Premium support with your dedicated mortgage advisor

- Learn more →

Thousands of users have already saved money on their mortgage

“Perch is the only place I'd recommend for anyone's mortgage needs. The platform makes the whole process a breeze to follow from start to end.”

Gabe + Becca First time buyers

“It was me and my husband’s first time buying and selling at the same time, and Perch was extremely helpful in navigating that process.”

Christine + Bryan Repeat buyers

“Highly recommend to anyone looking to get competitive rates and values transparency throughout their entire mortgage experience.”

RahulReal estate investor

“Perch is the only place I'd recommend for anyone's mortgage needs. The platform makes the whole process a breeze to follow from start to end.”

Gabe + Becca First time buyers

“It was me and my husband’s first time buying and selling at the same time, and Perch was extremely helpful in navigating that process.”

Christine + Bryan Repeat buyers

“Highly recommend to anyone looking to get competitive rates and values transparency throughout their entire mortgage experience.”

RahulReal estate investor

Straightforward, simple mortgages

Getting a mortgage doesn’t have to be a painful process. Sign up, add your details, pick your mortgage and hit submit. Consult one of our mortgage advisors if you want to strategize, but only on your terms (no sales pitches here).

Streamlined and efficient, all online

Forget the hassle of submitting your documents to multiple mortgage lenders and waiting for a phone call. We’ve automated our mortgage process online, so it’s easy to get the answers you need with a lot less chasing.

Whether you’re a phone person, or prefer to chat online, our experienced mortgage advisors are available 7 days a week. We’ll even send reminders and alerts so you don’t miss a thing.

Let’s face it - no one likes shopping for a mortgage. This is the mortgage experience Canadians deserve.Read more

Maximize your savings

It’s easy to find the best mortgage that saves you money. Try it yourself, and browse 30+ mortgage lenders all in one place. Perch users save an average of $3,000 in mortgage interest per year.

Are there any fees to use Perch?

It’s free to use our tools and calculators or to get a mortgage. Our goal is to help you navigate the mortgage marketplace, at no cost to you. It’s our job to know the in’s and out’s of every mortgage out there, and to understand which mortgage lenders can turn things around quickly.

We get paid by the mortgage lender once you choose your mortgage. Perch is available across all provinces and territories in Canada, including Ontario, British Columbia, Alberta and Quebec.Read more

Hot off the press

Money, mortgages and real estate in everyday English. Refreshing, right?

The Bank of Canada holds interest rates on...

The Bank of Canada announced on January 28th that they will hold their policy interest rate, keeping it at 2.25%. Key Takeaways The Bank of Canada has held their policy interest rate, which keeps it...

Home Ownership Is Getting Easier, But Not Across...

The sticker shock of Canadian real estate hasn’t gone away, but the door to ownership is cracking open for those willing to adjust their approach. From our vantage point, demand hasn’t...

The Bank of Canada holds interest rates on...

The Bank of Canada announced on December 10th that they will hold their policy interest rate, keeping it at 2.25%. Key Takeaways The Bank of Canada has held their policy interest rate, which keeps it...

The Bank of Canada cuts interest rates on October...

The Bank of Canada announced on October 29th that they will cut their policy interest rate, which brings it to 2.25%. Key Takeaways The Bank of Canada has cut their policy interest rate, which brings...

The Bank of Canada cuts interest rates on...

The Bank of Canada announced on September 17th that they will cut their policy interest rate, which brings it to 2.50%. Key Takeaways The Bank of Canada has cut their policy interest rate, which...

Your questions, answered

To get pre-approved for a mortgage, you’ll need proof of assets and income (like bank statements), good credit and other types of documents such as government-issued photo ID.

Your mortgage advisor will review your situation and discuss which mortgage options make the most sense for you. Then, they will submit your mortgage application to the lender. Once approved, the lender will issue a mortgage commitment letter, which outlines what conditions need to be met in advance of your closing date.

When all conditions are met and documents signed off, the mortgage lender will release the funds to your real estate lawyer.

A mortgage lender loans you the money upfront to buy property, and in return, you’ll pay them interest on the loan. Your property is used as collateral for the loan, which enables the mortgage lender to take ownership of your property if you default on your mortgage payments. In Canada, a power of sale is the most common process used when a borrower doesn’t pay their mortgage as agreed. In a power of sale, the lender obtains the legal right to evict residents of a property and sell the property to recover any owed funds.

Picking the best mortgage can feel overwhelming. Other than finding a low mortgage rate, you’ll want to ask yourself questions, such as:

- How long do I anticipate owning this property?

- How important is a low monthly mortgage payment compared to the flexibility of paying down my mortgage ahead of schedule?

- Do I have the financial resources to handle a higher mortgage payment?

- What are the mortgage penalties if I decide to sell?

Your answers will impact the term length of your mortgage, whether you should go with a fixed or variable mortgage rate, and how much prepayment flexibility you really need. You can view your best mortgage offers, then consult one of our Perch mortgage advisors to strategize what makes sense in your situation.

As you can see, picking the right mortgage involves more than just finding the best rate. However, you may be surprised to learn that who the mortgage comes from doesn’t matter as much as you think. After all, the mortgage lender is the one loaning you money, and not the other way around!

A mortgage pre-approval can be considered a “light approval”, but is not a guarantee by the mortgage lender. A mortgage pre-approval helps confirm what you can afford to borrow. If you’re planning on buying a property, a mortgage pre-approval should ideally be completed 1-2 months before you expect to buy. For more information, refer to our Canadian Home Buying Guide.

To get pre-approved for a mortgage, you’ll need to have:

- Proof of income, such as pay stubs or tax returns

- Proof of assets, such as bank statements or investment account statements

- Good credit, with a minimum score of 620

- Proof of identity, such as government-issued photo ID and your Social Insurance Number (SIN)

Gathering documents ahead of time will help make getting a mortgage a smoother and simpler process. You can typically download many of these documents through an online account manager from your bank, payroll provider, and the Canada Revenue Agency.

Not ready to get pre-approved? Calculate your purchasing power and see if you can afford your target property.

Canadians typically get a mortgage loan by going directly to a mortgage lender, such as a bank, or by using a mortgage broker. Whether you use a bank or a mortgage broker, you aren’t charged a fee for using either service. Mortgage brokers are paid directly by the mortgage lender for their services.

As a mortgage lender, a bank will only promote their own mortgages, which means you have access to a smaller selection of mortgage products, compared to shopping around through a licensed mortgage broker. A mortgage broker has access to mortgages from multiple lenders, making it easier to find the best deal.

Banks in Canada will operate with limited hours during business days, which can be frustrating if you’re in a hurry or work a 9-to-5 job. If you need a mortgage urgently with a quick turnaround, or have a question about your mortgage application, it can be tough to get answers on a weekend, evening or statutory holiday. Perch operates 7 days a week, so you never have to worry about a mortgage advisor being inaccessible.

Unlike hiring a real estate agent, mortgage lenders and mortgage brokers don’t require you to sign an exclusivity agreement to work with them. Shop around before committing to a mortgage, it could translate to thousands of dollars saved each year.

When you use a mortgage broker like Perch, you’ll get:

- Access to mortgage products from 30+ mortgage lenders

- Dedicated support 7 days a week, including evenings and holidays

- A streamlined, modern approach to comparison shopping for the best mortgage

Our mission is to help you buy your first property sooner so you can build wealth through real estate. Get pre-approved fast with Perch, and access the financial insights you need to make the right decision. Along with smart real estate tools to find and manage your mortgage, you’ll also have on-demand access to our experienced mortgage advisors at every step.

Perch makes the process of buying a property simpler and easier, and helps you save money on your mortgage. Once a homeowner, we enable you to build wealth by maximizing your home equity. In other words, we help your money make more money. Talk about a win-win.

Looking for more answers? See all FAQs →