Read the May 2023 Canada interest rate forecast.

Read the July 2023 Canada interest rate forecast.

Once again all eyes are on the Bank of Canada for their decision during the next interest rate announcement on June 7th. With recent data showing inflation hasn’t continued slowing in April and GDP growth surpassed expectations, the market is factoring in a slightly increased chance that there may be another rate hike on the way. Let’s take a look at how the economy is doing going into June and what’s going on in the mortgage world.

Key Takeaways

- Bank of Canada has paused rate hikes for the time being, with the next announcement coming on June 7.

- For buyers, there are great opportunities in the market, but inventory is low across the board.

- Today’s best mortgage rates are 4.74% for 5-year fixed and 5.95% on 5-year variable.

- For homeowners coming up for renewal, continue to monitor our rate forecast and avoid taking the first offer from your existing lender, as they’re typically less competitive.

Here’s how the mortgage market is doing:

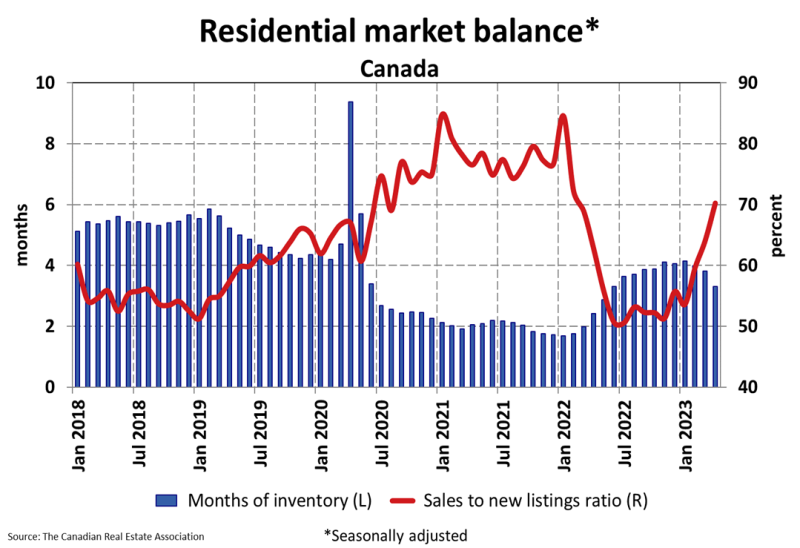

For the month of June, we anticipate fixed rates will increase slightly and variable rates will remain the same. Canada’s national sales activity continues to rise, now at double digit growth (11.30% month over month) while the number of new supply has increased ever so slightly (1.60%), keeping supply levels at 20-year lows. As supply levels continue to play catch up to sales activity, we will continue to see record breaking sales-to-new listings ratios, which tip the market in favor of sellers, as we’ve come to see in March (64.10%) and more recently April (70.20%). The Aggregate Composite MLS Home Price Index was up a further 1.60% on a month-over-month basis in April, a notable jump from 0.20% in March. Home prices have risen since January, but we anticipate this trend to taper off as we head into the summer.

All eyes are on the Bank of Canada

Markets and economists have only received small snippets from the Bank of Canada regarding its future decisions and what might come next on June 7th. With the Last announcement being on April 12th, the markets scurried from one end to the other, as both positive and negative data came to light. The Bank of Canada finds itself at a crossroads, with Canadians facing higher costs of everything, including shelter, groceries, and energy, choosing to hike their key rate will only add fuel to the fire, that is inflation, as the mortgage cost index has been the strongest upward driver of inflation for the past 5 months. On the other hand, should Tiff Macklem and the Bank of Canada choose to pause once again, markets will lose faith in the Central Bank’s ability to tame inflation, contributing to a further interest rate gap between us and our neighbors down south, this will negatively impact the value of the Canadian dollar versus the US dollar. Once the value of our Loonie weakens, we will be importing inflation, as the cost of goods coming from south of our border will increase. We are betting there will be another pause, as the Bank of Canada waits to see how the economy and inflation are trending over a longer time period.

Canada’s economy surpasses expectations

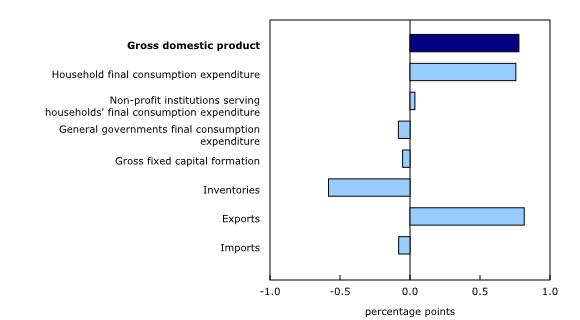

Stats Canada reported GDP numbers on March 31st, the Canadian economy grew by 0.80% in the first quarter, led by household final consumption expenditure and exports, an increase from the 0.00% growth we saw in the fourth quarter of 2022. When annualized, GDP sits at 3.10% vs the widely expected 2.50%, however according to Stats Canada, housing investment, business investment in machinery and equipment, and inventory accumulation all continue to decline. It is quite clear that we will see the anticipated slow down in the coming quarters as expected once higher interest rates continue to work their way into the economy. In our opinion calls for another rate hike would be premature given the data available, the Bank of Canada might choose to wait until June’s Job market report to weigh their options.

Inflation isn’t slowing as fast as hoped

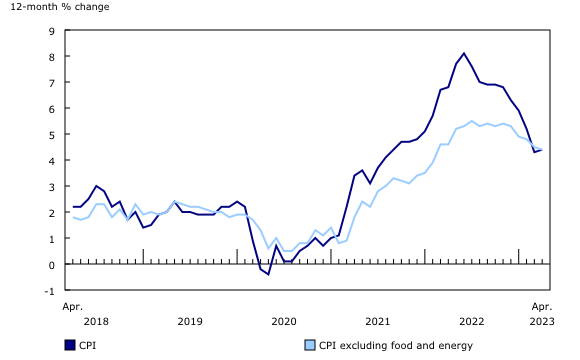

For the first time since 2018, both CPI and CPI excluding food and energy accelerated at the same level in April (+4.40%). It appears that inflation is heading in the wrong direction, rising 0.10% from March’s CPI (+4.30%), marking the first reversal of direction since June 2022. Gasoline prices were back on the rise in April, in part due to OPEC’s decision to lower output volume, all while rising mortgage interest rates continue to apply the highest upward pressure on the CPI for the 5th consecutive month. Canadians shopping for a new home or renewing their mortgage in April are experiencing a 28.50% increase in mortgage costs versus a year ago, the largest yearly increase on record. We expect the CPI to decelerate in May below 4.00% and trend closer to the Bank of Canada’s revised inflation outlook of 3.00% by June.

The job market continues to be strong, with Canadians lining up to work

According to Stats Canada Job vacancies decreased by a further 2.10% in March following a 4.00% decrease in February, the lowest since August 2021, this puts the job vacancy rate at -6.50% year to date. There were 1.3 unemployed persons for every job vacancy in March 2023.

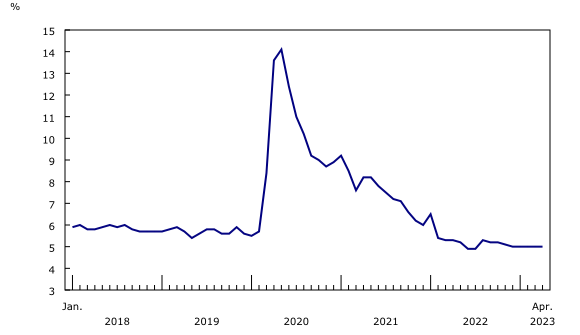

Canada added 41,000 new jobs in April, mostly part time jobs, however a large number of them are actively looking or prefer full time jobs, an increase from the 35,000 jobs added in March, once again, passing expectations. The unemployment rate continues to hold at 5.00%, for the fifth consecutive month, which should begin to increase in the coming months as higher interest rates continue to work their way into the economy.

Average weekly earnings grew 5.40% year-over-year in April, up 0.90% from January (4.50%). The central Bank anticipates weaker economic growth in the upcoming quarters to ease pressures in the labour market and moderate wage growth however warning that “unless a surprisingly strong pickup in productivity growth occurs, sustained 4% to 5% wage growth is not consistent with achieving the 2% inflation target.”

Canada’s population on track to hit 40 million next month

Canada’s population is growing, Canada will officially join the 40 million club sometime in June, the Central Bank continues to warn that strong population growth is supporting aggregate consumption and employment growth all while the Federal Government continues to push for a goal of 1.4 million new immigrants in the next 3 years. People are searching for rentals amidst the unaffordability crisis Canada faces due to low inventory and high interest rates, causing rents to continue to rise, +6.10% in April.

Recommended reading: How does population affect the housing market?

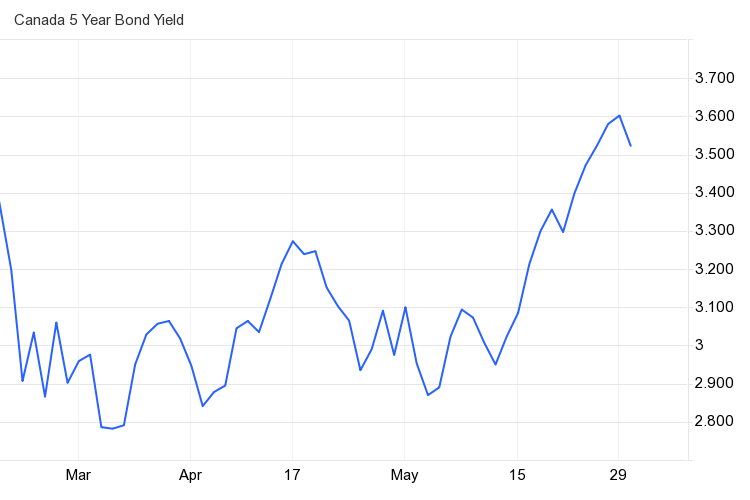

Bond yields are on the rise!

The month of May has been quite unpredictable, with yields increasing by 70bps since the beginning of the month, as higher than anticipated CPI, seemingly never slowing job reports and a struggling Loonie have all swayed market sentiment ever so slightly in favor of a rate hike by the BoC on June 7th. Markets continue to lack faith in the Central Bank’s toolbox and ability to guide the Canadian Economy back to course and tame inflation.

If you’re looking to buy a home in Canada:

Our current best 5-year fixed rates is 4.74% and 5-year variable rate of 5.95%.

For first-time home buyers, there are some great opportunities outside of core cities, however as the narrative begins to change and the negative sentiment subsides, expect higher competition, especially as inventory is at 20-year lows.

For homeowners who are coming up for renewal, continue to monitor our rate forecasts, it would be wise to see what rates Perch may be able to offer above and beyond your existing Lender, as they’re typically less aggressive on their rate offerings.

For homeowners who would like to see the benefit of switching lenders and breaking their mortgage early, Perch automatically calculates the net benefit once you input your existing property and mortgage details in your Perch portfolio.

June 2023 mortgage interest rate forecast newsletter

Ali

Ali