We sat down with our friends at Konfidis to discuss what you need to know about population and the housing market.

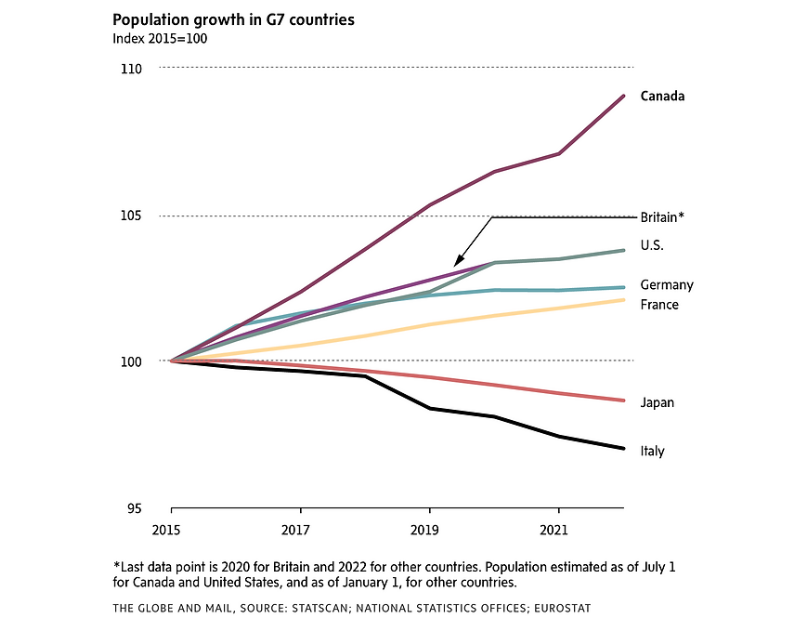

Canada’s population grew more in 2022 than in any other year since Confederation. Statistics Canada said the country’s population grew by 362,453 people, or 0.9 per cent, between July and October of 2022 alone. That influx of people over the three-month period was more than the total population growth in all of 2011 and the fastest single-quarter growth rate since the second quarter of 195, during the post-war baby boom.

Some analysts are predicting that the federal government’s push for record immigration could be good news for real estate investors. Our partners over at Konfidis use data-driven insights to analyze the market including real-time MLS data and they’ve shared with us how they think population growth may be affecting the housing market.

How does population growth affect the housing market in Ontario?

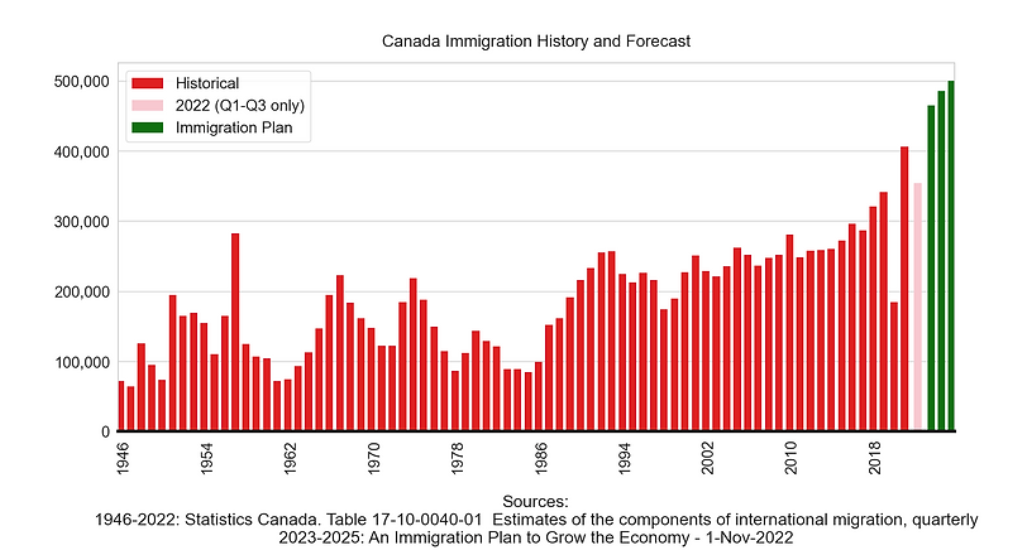

In November of 2022, Ottawa unveiled plans to admit 500,000 immigrants a year starting in 2025 to address labour-shortage issues. Those include a million job vacancies across the country and an aging work force. The new targets represent a significant increase over the 405,000 immigrants admitted in 2021.

Let’s put these record-breaking numbers of new entrants to Canada in context. First, the charts below show the historical annual immigration statistics for Canada and Ontario in context with the three-year forecasted numbers. These charts highlight 2022 as a standout year, as well as the continued outsized immigration targets through 2025 compared to historical statistics.

Immigration and population growth lead to household formation, the primary demand driver for housing. The makeup of this outsized population growth described by the data above supports both demand for housing ownership (i.e. the price of homes) and the demand for rental housing alternatives when the supply is not enough to meet that demand.

With this backdrop, Konfidis sees a compelling landscape for single-family rental ownership in the real estate market as the long-term supply and demand fundamentals support strong price appreciation if these trends continue

Is housing supply enough to account for increased demand?

Policy makers say higher immigration is necessary to fuel Canada’s economic growth, and in particular, to ease labour shortages, but with a population boom comes growing pains. Every year, Canada adds another big city – in a sense. The mass of individuals are spread around, mostly to urban centres, but increasingly to suburbs and far-flung communities. Consider that over the past year, fewer than 200,000 housing units were completed. There were 3.6 new residents for every home added, the highest ratio since at least 1991. There is a fundamental mismatch between home supply and demand – and the population boom is contributing to the divide.

So how will the housing market keep up with the increasing population?

The task ahead is nothing short of gargantuan. CMHC says that, in order to restore affordability back to levels in 2003 and 2004, Canada would need to build 3.5 million more homes than projected by 2030. Earlier this year, the federal government unveiled billions in new spending for housing, with a goal of doubling construction over the next decade. That plan looks dead on arrival amid higher borrowing rates and decreased building permits. With all this in mind it seems increasingly likely that when interest rates stop increasing, the demand for housing without an adequate supply to accommodate it will lead to further housing price appreciation.

________________________________________________________________________

Thank you to Konfidis for sharing these insights with us. Konfidis is dedicated to suppling Single-Family investors with investment properties to buy. Konfidis uses advanced technology to review thousands of properties in real time to ensure their clients are investing in top performing properties. Konfidis also provide regular newsletters helping investors stay abreast of the market with research, analaysis and insights from the Konfidis team on topics impacting Single-Family rental investors.

At Perch we’re dedicated to finding you the best mortgage for your situation, whether you’re an aspiring investor or a first-time home buyer. Shop our best mortgage rates today and you could save thousands over the length of your mortgage.