Read the December 2022 Canada interest rate forecast.

Read the February 2023 Canada interest rate forecast.

There’s no doubt, 2022 was a challenging year for many Canadians faced with consecutive interest rate hikes by the Bank of Canada, eye-popping inflation numbers and a slowing real estate market. While rates remain high, we predict the latter half of 2023 should bring (eventual) relief. That means good news for home buyers, borrowers and real estate investors. Let’s dive in, shall we?

Fixed rates to remain unchanged, while variable rates increase

In January 2023, we anticipate fixed mortgage rates will stagnate and variable rates to increase slightly as the Bank of Canada potentially increases its overnight lending rate. According to the latest numbers from CREA, national sales activity declined by 3.3% month-over-month in November 2022 and the number of newly listed properties edged down 1.3% month-over-month. We expect December sales data to follow the same trend nationally, and negatively impact market sentiment as we head into a historically lower inventory month of January.

Based on our insights, here is Perch’s forecast for 5-year variable rate mortgages in Canada from 2023 to 2027. Relative to June 2022, accelerating inflation data has resulted in the Bank of Canada front loading more of the rate hikes instead of gradual increases. In later years (2025 and onwards), rates are expected to be roughly 0.50% lower than they were expected in June. The chart below displays how our forecast has changed over time, referencing the past two quarters.

Economists predict a final rate hike at the next Bank of Canada meeting

On December 7th, 2022, the Bank of Canada raised its policy interest rate for the seventh time that year. It was the fourth time a raise of 50 basis points was made necessary. The current policy interest rate is now 4% higher than what it was almost a year ago, on January 26th, 2022. With the next Bank of Canada rate announcement scheduled for Wednesday, January 25th at 10:00 AM Eastern Time, many are wondering if the end of the rate hike cycle is finally here. We expect the Bank of Canada to raise its overnight rate by a further 25 basis points in the first meeting of 2023.

BMO's chief economist Douglas Porter is also predicting the Bank of Canada has one more rate hike in store in January and will then hold rates at 4.5 per cent through the rest of 2023. BMO's forecasts show inflation will remain stubbornly high, especially through the first half of the year.

Effects of recent rate hikes not yet fully realized

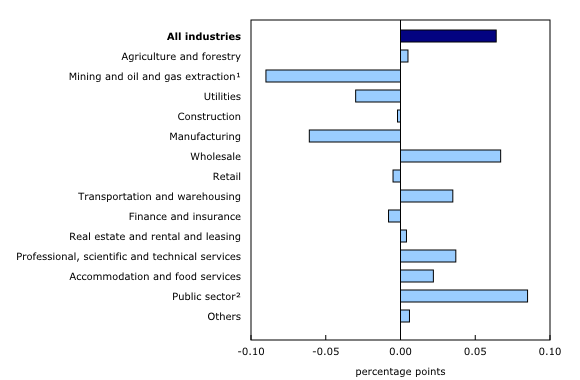

The Canadian economy has proven resilient in the face of record high interest rates and overall economic slow down. According to Statistics Canada, Real GDP edged up in October (0.1% month over month). Growth in services-producing industries (+0.3%) was partially offset by a decline in goods-producing industries (-0.7%), as 11 of 20 industrial sectors increased in October. GDP, while near zero, is still positive. Senior economists are warning that its still too early to see the effects of the BoC aggressive rate hikes, which will be more prevalent in the first quarter of 2023. November 2022 GDP numbers will be released on January 31, 2023.

Short term pain for longer term gain

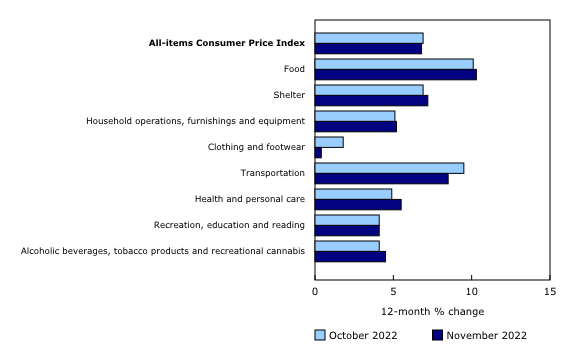

Following a 6.9% year over year increase in October, the Consumer Price Index (CPI) rose 6.8% year over year in the month of November. Excluding food and energy, prices increased 5.4% year over year. Prices for shelter, which are influenced mainly by mortgage interest cost (up 14.5% year over year) and rent indexes (up 5.9% year over year) have risen 7.2% year over year. Essentially, the Bank of Canada is further contributing to the inflation they are trying to tame by aggressively raising the policy interest rate, while hoping that a slowdown in the growth of homeowners' replacement cost index (up 5.8%) and other owned accommodation expenses (up 3.7%), which includes realtor commission fees will moderate the year over year price increase in the shelter component of the CPI.

Job vacancies continue to drop...

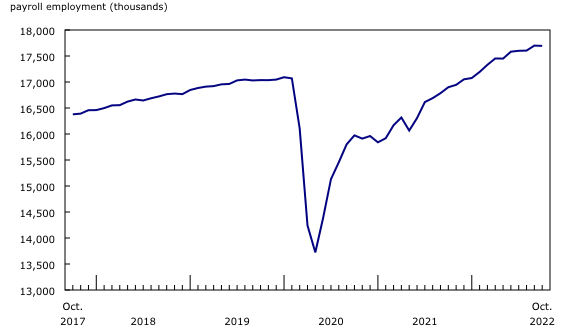

Job vacancies hit 15-month low as they fell by 44,300 (-4.8%) in October 2022, a large drop since the record high vacancy level in May 2022. According to Statistics Canada, there were 1.2 unemployed persons for every job vacancy in October, up from the low of 1.0 in June, but down from 2.0 in February 2020, prior to the pandemic.

...which led to wage growth in a tight labour market

All provinces recorded year-over-year growth in average weekly earnings. Average weekly earnings grew 3.4% (year-over-year) in October, that’s .03% faster than in September (3.1%). Increase in average weekly earnings can reflect a few factors, including changes in wages, in the composition of employment and in hours worked. Wage growth and a tight labour market has been a sticking point for the Bank of Canada, who would like to see wage growth slow down and unemployment increase before letting off the gas pedal on rate hikes.

Canada's population continues to grow

Canada’s population is growing faster than ever before, and it’s all thanks to immigration. According to Statistics Canada, as of October 2022, 362,453 people have immigrated to Canada since July 1, 2022, an increase of 0.9%, marking the highest quarterly population growth rate since the second quarter of 1957 (1.2%). While most of the third quarter population growth numbers were driven by an increase of 225,198 non-permanent residents who were already here on work permits, this increase in one quarter was larger than any full-year increase since 1971.

Bond yields

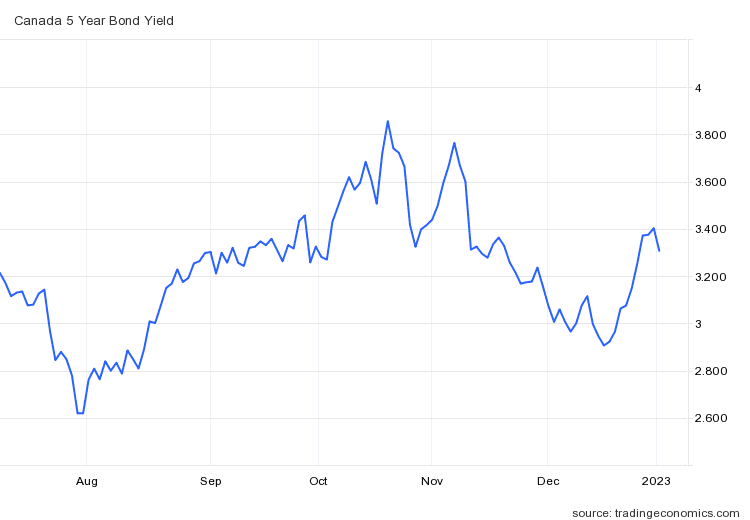

5-year bond yields bottomed at 2.9% in mid December, pushing lenders to decrease long term fixed rates well below 5% for the first time in nearly 6 months. While bond yields have trended back above 3% at the end of year, we see no further incoming increases to fixed rates in the near term as lenders compete during a slower December and January, variable rates could stagnate in 2023 and become a popular option once again as the Bank of Canada rate hike cycle ends.

The best 5-year fixed rate is 4.59% and 5-year variable rate is 5.31%

- For first-time home buyers, there are some great opportunities in a market dampened by negative sentiment and overall lack of competition.

- For homeowners who are coming up for renewal, continue to monitor our rate forecasts. It would be wise to renew into shorter mortgage terms until rates begin to decrease in the second half of 2023.

- For homeowners who would like to see the benefit of switching lenders and breaking their mortgage early, Perch automatically calculates the net benefit once you input your existing property and mortgage details in your Perch portfolio.

Ali

Ali