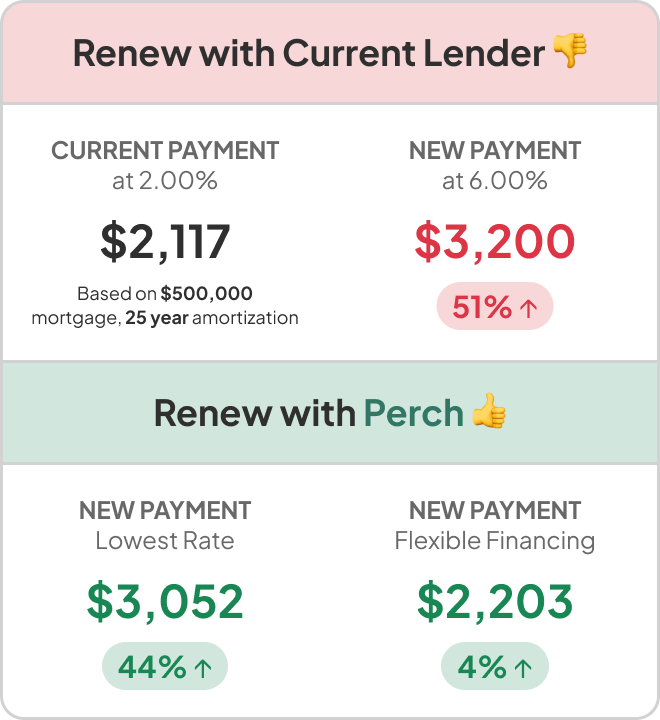

| Save money on your mortgage. Learn about what your payment could be at renewal and how you can save by renewing your mortgage with Perch. |

The Bank of Canada announced on January 24th that they will hold interest rates steady for the time being. The current overnight rate remains at 5.00%.

We predicted that the Bank of Canada would hold rates steady in our interest rate forecast as a result of slowing inflation and a weakening economy.

The current overnight rate remains at 5.00%.

Key Takeaways

- The Bank of Canada has kept their policy interest rate steady at 5.00% as of their latest interest rate announcement

- The next interest rate announcement is on Wednesday, March 6, 2024.

- Our January mortgage outlook: fixed rates will drop and variable rates will remain the same.

- Talk to an experienced mortgage advisor to understand the announcement’s impact on your mortgage payment or upcoming renewal

Why did the Bank of Canada hold interest rates?

The latest Bank of Canada interest rate announcement occurred on January 24th. The Bank of Canada has been signaling for a while that they want to see the impact of their previous hikes play through the economy and are holding steady until they can determine that it was enough to bring inflation back to their target. We don’t expect to see any cuts until Q2.

Commentary from Perch’s CEO and Principal Mortgage Broker, Alex Leduc:

2024 is shaping up to be a great year for mortgage holders. Rates are expected to decrease by around 1% over the course of 2024, with the decline potentially starting as early as Q2. Long-term interest rates have already dropped by about 1% relative to September’s expectations. That means cumulative rate cuts will be about 2.25% over the next 2 years and will normalize at that level. With a large amount of mortgages set to renew in 2025/26, the timing couldn’t be better.

In the chart below, you can see how our 5-year variable rate forecast has changed over time based on the Bank of Canada interest rate announcements. (Like what you see? Sign up to get free, personalized mortgage insights and our monthly mortgage outlook!)

The current focus for the Bank of Canada remains bringing inflation back in line with the targeted 2%. The Bank of Canada is anticipated to begin cutting rates in late 2024 into 2025. During the next few years adjustable rate mortgage holders are likely to see lower payments.

Related: Why are variable rates higher than fixed rates?

Buying now gives you the opportunity to lock in a lower purchase price in today's market, benefitting you in the long run. Think of it this way: You date the mortgage payment, but you marry the purchase price.

In other words, your mortgage payment can fluctuate as you change terms, but your purchase price remains the same.

We increasingly see new buyers opting for a shorter mortgage term with a higher amortization to minimize their monthly payments. This enables them to potentially renew at a lower rate a few years from now, and in the long run, accelerate their amortization to pay off their mortgage earlier.

How will the latest Bank of Canada interest rate announcement affect home prices?

For the month of January, we anticipate fixed rates will drop and variable rates will remain the same. National sales activity edged down further in November by 0.9% month over month, remaining on trend with September’s and October’s declining sales activity. Canada’s inventory edged down by 1.8% month over month in November, the second consecutive decline we’ve seen since March. Sales activity has officially tapered off and inventory is now on a seasonal decline, contributing to a sales-to-new listings ratio of 49.8% in November, a small increase from the 49.4% in October, in comparison, this ratio peaked at 67.9% in April.

“I wouldn’t expect anything too headline-grabbing from the resale housing market for the next few months,” said Larry Cerqua, Chair of CREA. “That’s a good thing, because a market that looks to be stabilizing in balanced territory increasingly suggests the soft-landing scenario.”

Where will mortgage rates be in 2024?

According to financial models by Alex Leduc, Principal Broker at Perch, 5-year variable mortgage rates should start dropping in late 2024.

Will mortgage rates go up in the next 5 years?

Based on our latest Mortgage Rate Outlook, expect 5-year variable mortgage rates to start dropping in 2024 and continue doing so into 2025. We'll be updating our mortgage rate forecast after every Bank of Canada interest rate announcement – you can subscribe to our mortgage rate forecast for free.

Don't miss the opportunity to boost your buying power by up to 50%

What is the Bank of Canada interest rate today?

The current Bank of Canada interest rate sits at 5.00%, with a 0.25% rate hike announced on July 12, 2023.

When is the next Bank of Canada interest rate announcement?

The next scheduled Bank of Canada interest rate announcement is Wednesday, March 6th, 2024 at 10:00 AM ET.

What are the interest rate announcement dates in 2024?

There are a total of 8 Bank of Canada interest rate announcements each year. The dates for 2024 are as follows:

- Wednesday, January 24, 2024

- Wednesday, March 6, 2024

- Wednesday, April 10, 2024

- Wednesday, June 5, 2024

- Wednesday, July 24, 2024

- Wednesday, September 4, 2024

- Wednesday, October 23, 2024

- Wednesday, December 11, 2024

(Source: Bank of Canada)

The Bank of Canada typically makes their interest announcement at 10:00 AM Eastern Time.

Here's what else we're reading:

How big should my downpayment be? (3 min read time)

Fixed or Variable? How to choose the right mortgage for you (4 min read time)

5 things first-time home buyers should know about getting a mortgage (3 min read time)