Canada Home Buying Guide 2026

by: Perch Buying + Selling Tips + Tricks

What you’ll find in this guide:

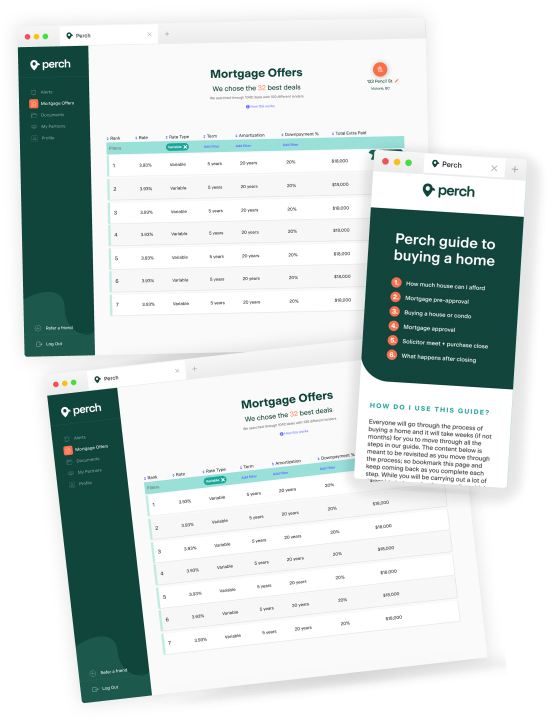

How do I use this guide?

Everyone will go through the process of buying a home and it will take weeks (if not months) for you to move through all the steps in our guide. The content below is meant to be revisited as you move through the process; so bookmark this page and keep coming back as you complete each step. While you will be carrying out a lot of this guide independently, we outline which parties are relevant in each step and we’d encourage you to read through this content so you are better informed before meeting and as you work with them.

We will be constantly updating this page to include more content and ensure it stays relevant, so we recommend revisiting the site rather than just printing the screen.

If you have a Perch profile:

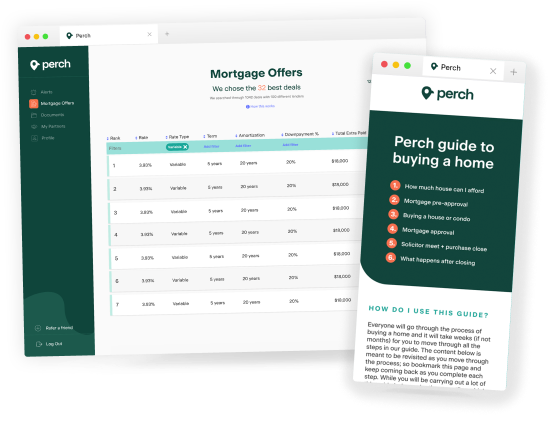

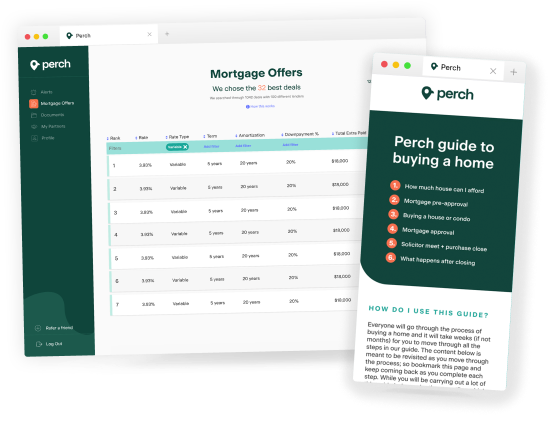

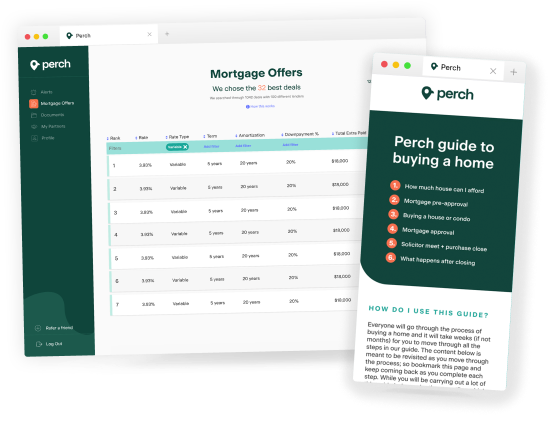

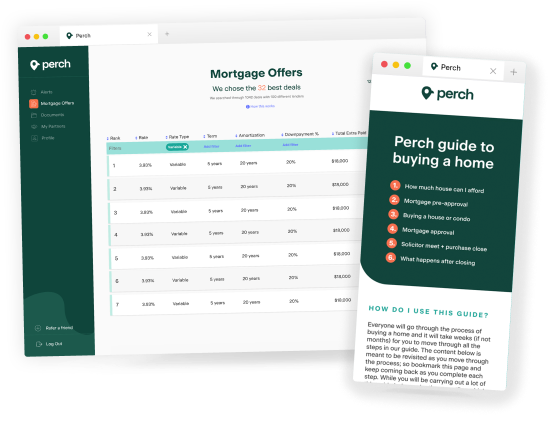

The Perch platform (free to use) is built around this guide, but we leverage analytics, automation and our team of experts to make sure you don’t miss anything and make it easier to move through each step. Your Perch profile will specifically refer to this guide when relevant.

Don’t have a Perch profile?

You may have your own preferences and that’s fine; the content is free for you to use. The process is no different, there are just some sections that you will have to do more research/calculations on as we can’t generate the outputs for you without having any of your data.

Step 1:

How much house can I afford?

Your ability to buy a home is mainly determined by three things:

- Do I have enough savings for a downpayment?

- Do I make enough income?

- Is my credit score high enough?

Perch perk:

Our Mortgage Affordability Calculator takes these 3 factors into account and does all the calculations we outline below to give you a good estimate of what you can afford.

A more accurate calculation can be found within your Perch dashboard, which incorporates these 3 factors and other technicalities (ex: if you own other properties).

Do I have enough savings?

When you buy a property, it will be through a mixture of your own savings and a mortgage. The portion coming from your savings is referred to as your down payment. People will typically refer to their down payment in percentage terms such as “I’m putting 20% down”, this means that their down payment is equal to 20% of their purchase price.

Minimum down payment required

It should be mentioned that mortgage insurance doesn’t come for free and this premium (calculated as a percent of your mortgage amount) is added to your principal balance and you pay it off with your mortgage over time (note that this means you pay the premium AND pay interest on that premium amount). You can view CMHC’s insurance premiums here to get an idea of the cost. If your property isn’t eligible for mortgage insurance or you’d rather avoid paying the mortgage insurance premiums, you will always need at least 20% down payment.

What can I use as down payment?

The most commonly used sources of down payment are:

Stocks, mutual funds or any other kind of investment that can be sold within 60 days. Funds from your RRSP can also be used, but unless you are using your Home Buyer’s Plan (available only to first time home buyers), you will need to pay withholding taxes when you take the funds out.

In some cases, you can borrow funds (personal loans, lines of credit, etc) to top up your down payment. You should discuss this option with your mortgage representative to see if it makes sense for you as not all lenders allow it.

While you won’t need the full down payment until your purchase closes (which can be months after you make an offer), the seller will likely require you to put down a deposit (typically 3-5% of the purchase price). Thus, you should make sure that you have funds available when you start house hunting to put down as a deposit (your realtor will go over how much is required).

Do I need anything other than a down payment?

On top of the down payment, you will need to budget for closing costs. These cover things such as your legal costs, service providers (ex: appraisers) and any taxes/fees payable. These vary quite a bit depending on many factors such as if you’re a first-time home buyer and what province you live in. Your solicitor will give you an exact statement for closing costs prior to your closing date, but our Closing Cost Calculator can help give you a ballpark number today. Closing costs include things such as:

- GST/HST: Will differ based on your province, but some items in your purchase may be subject to taxes (ex: mortgage insurance premium)

- Legal Fees: Every deal requires a solicitor

- Land Transfer Taxes: Will vary based on the city and province. If you’re a first-time home buyer you may be eligible for rebates

- Title Insurance: Performed by the lawyer to ensure the property you’re buying is what you think it is and owned by the seller rightfully. This is required by lenders.

- Lender/Broker Fees: Mainly for alternative lending or private mortgages, brokers or lenders may charge a fee

- Appraisal: Depending on your down payment % and the lender, you may need to get an appraisal on the property. These usually cost around $400. An appraisal is when a real estate professional will visit the home and assess the value of that property

Perch perk:

Use our Closing Cost Calculator to get a customized estimate of what your closing costs would be.

Do I make enough income?

Having the right amount of down payment is key, but how much mortgage you can afford will also be determined by your qualifying income.

Why does my income matter?

You likely have heard the term “mortgage stress test” before and this is what it relates to. At a high level, mortgage stress tests are rules laid out by the government/regulators that set limits to how much someone can borrow. There are 2 main ratios, the Gross-Debt-Servicing (GDS) and Total-Debt-Servicing (TDS) ratios. The only difference between GDS and TDS is that TDS includes debt payments, which are certain debts (ex: personal loans, car loans/leases, student loans, etc) and don’t include things like your monthly credit card bill, your phone bill or other expenses.

*Note that the Mortgage Payment is calculated using the stress test rate and not your actual rate. This is the greater of your mortgage rate + 2% or the Bank of Canada posted mortgage rate (they describe it as “Conventional mortgage- 5 year”).

Example:

You make $60,000 a year and want to buy a $400,000 condo with 20% down payment (which means you have a $320,000 mortgage). Assuming a 7% qualifying mortgage rate, property taxes of $2,400/year, heating of $100/month, condo fees of $500/month and a $400/month car lease your TDS would be as following:

GDS Numerator: $2,108 + $2,400/12 +$100 +$500/2 = $2,658

TDS Numerator: $2,658 + $400 = $3,058

GDS/TDS Denominator: $60,000/12 = $5,000

GDS = $2,658/$5,000 = 53.2%

TDS = $3,058/$5,000 = 61.2%

In most cases, lenders will allow a maximum of 39% and 44% for GDS and TDS respectively to qualify. So in the example above, you wouldn’t qualify for that mortgage. If you visit our Tools page, the Mortgage Affordability Calculator does these calculations for you and gives you insight into what you need to qualify if you come up short. You can also use the Mortgage Calculator to estimate your mortgage payment.

What income can I use?

Unfortunately, this answer is not straight-forward since all lenders have their own rules and the regulator can change the regulations pertaining to qualifying income (which may not equal your total income). You’ll determine your qualifying income as part of the pre-approval process when you meet with your mortgage representative but if you’d like to know how it’s calculated we cover qualifying income in these articles:

- If you are a full-time, part-time or hourly employee of a company that you do not own and are on their payroll (you receive a T4 from your employer) read this article.

Is my credit score high enough?

In Canada, your credit score is usually obtained through two provider: Equifax or TransUnion. Credit scores range from 300 to 900, with the highest score (900) being the best you can possibly have and 650 being the average (according to TransUnion). You can read more about how your credit score is calculated here.

What credit score do I need for a mortgage?

Having a low credit score (under 600) doesn’t mean you can’t get a mortgage, it just means your mortgage rates will likely be higher and you will not be eligible for mortgage insurance (so you need at least 20% down payment). Assuming you want good mortgage rates, you will need at least a credit score of 620 and ideally you will have a credit score above 680. This is because each lender sets their minimum credit score requirements, so being between 620 and 680 means that you may not be eligible for certain rate promos at specific lenders and you get higher rates as a result.

Getting a copy of your credit report will enable you to see your current score and track your progress. You can also make sure there are no errors (it happens) and if there are correct them ahead of time so your credit is cleaned up by the time you’re submitting a mortgage application.

What if I’m buying with someone else?

Should I buy based on what I’m qualified for?

The steps outlined above let you know how much house you can “technically” afford. However, this doesn’t mean that you need to max out your purchasing power. Being “house poor” means you can’t do anything because all your money is going towards your property and that is definitely not any fun. You should budget what you’d be comfortable spending per month on your property, determine what that equates to as a mortgage balance and then add your down payment to that number to determine your purchase limit (which should be less than or equal to what you qualify for). For example, let’s say that you had $50,000 available as down payment and you didn’t want to spend more than $2,000 a month on your mortgage. Using our Mortgage Calculator (no need to adjust the rate, the tool assumes that you get the best current rates), adjust the purchase price and downpayment until you get to your target mortgage payment.

For example:

When I ran the tool at the time of writing this (rates of 4.80%), I calculated that the target purchase price (with a max mortgage payment of $2,000/month) was around $393,000. You would then compare that number against what you qualify for and take the lower of the two when going to purchase a home.

Step 2:

Mortgage pre-approval

This step involves:

Mortgage advisor

When do I need to get pre-approved?

A formal pre-approval is typically good for 90-120 days, so you should get one when you’re within 1-2 months of buying a property.

Why do I need a pre-approval?

Getting pre-approved essentially is going through Step 1 with a mortgage professional. During a pre-approval, they will confirm how much mortgage you can afford and you can then take this pre-approval confirmation with you when house hunting as many realtors will ask you to get a pre-approval letter when you’re submitting a purchase offer to strengthen your deal.

Does being pre-approved mean that your mortgage is guaranteed? Absolutely not

Pre-approvals are meant to be a “light” approval, where most lenders don’t fully review the deal but give you the green light that you should be fine if it was submitted as is. A pre-approval is not a binding commitment.

While there is a benefit to also locking in a rate as part of the pre-approval process, options will be limited. Most lenders don’t offer pre-approvals and those that do will typically add a premium to your pre-approval rate (usually around 0.25-0.5%) and promo rates are typically not eligible for pre-approval.

Therefore, the main benefit of a pre-approval is to solidify what you can afford and assume that the final mortgage rate will be determined once your offer to purchase a home is actually accepted.

Where do I get pre-approved?

You get pre-approved by the same people who would ultimately help you get your mortgage, so think of this as a good way of assessing your mortgage professional before you need them for the actual mortgage approval. This includes Perch, lenders (bank, credit unions, etc) or other mortgage brokers.

Perch perk:

Within your Perch profile, you can submit your request for a pre-approval with one of our mortgage experts in under 10 minutes.

Commonly asked questions

Why do I need to have my credit checked for a pre-approval?

Mortgage representatives can’t issue a pre-approval without pulling your credit. If your credit score was lower than you thought or there are debts that you weren’t aware of then these would directly affect your pre-approval amount and could create serious issues later on. It’s better to know upfront.

Also, credit inquiries only make up around 5% of your credit score, so getting your credit pulled shouldn’t materially affect your credit score. According to Equifax (who is one of the largest providers of credit scores), credit providers understand that you will likely be going to more than one place to get a mortgage quote and as a result count all credit pulls related to your mortgage inquiries as 1 pull within your 14-45 day period to minimize the impact on your credit score. This article by Equifax summarizes it really well.

Step 3:

Buying a property

This step involves:

Real estate agent

Seller

Which option is right for me?

You can have full service or no service (do it yourself) realtor services, which all have their own pros and cons. Picking the right option is like when you evaluate packaged vacations. If you don’t need everything, you may want to trim it down and just pay for the services you do need. The vast majority of buyers still use a traditional full service Realtor, but new companies and technological innovation have resulted in more people using new methods of purchasing a home (or a hybrid between new and traditional). The hybrid approach is where they use a professional for the core parts (ex: negotiating price) and then do more mundane tasks themselves (ex: schedule visits) in exchange for a lower commission cost.

Who do I pick?

According to the CREA, there are over 125,000 realtors in Canada. It’s especially important that you pick the right Realtor because you may have to sign an exclusivity agreement, which then makes it extremely difficult for you to switch Realtors if you’re unsatisfied. Most people typically pick based on a referral from friends and family alone, but you should evaluate them based on:

- Their reputation: This can be evaluated through online reviews; what are their customers saying about them?

- Their brokerage’s reputation: How reputable are they and how long have they been in business?

- Their experience: How long have they been in the industry and what are their credentials? If they’re newer, who is their mentor and what is their mentor’s experience?

- Their license: Get their license number and verify that they’re licensed using the provincial regulator’s website.

You should also not associate the newer methods of buying a home as lower quality, most of them are actually run by experienced realtors who see the demand for lower costs in exchange for less services or that effectively leverage technology to be more efficient than their competitors.

Perch perk:

Perch has an existing network of vetted realtors that we retain based on their ability to deliver quality service to clients. We’d be happy to connect you with one if you are still searching and can request to do so within your Perch profile.

What is the process to buying a house?

Note: depending on which realtor option you pick from, you may be completing some of the realtor functions yourself.

- You and your realtor assess your situation and review your pre-approval to determine things like your budget and your preferences (property type, neighbourhoods, etc)

- You will typically shortlist properties you like and then advise the Realtor to book a showing

- You visit properties with your realtor until you find an option you like

- Once you find a property you like, you submit offers (which your realtor will help you with) until your offer is accepted by the seller. Your offer will contain more than just your purchase price, you will also specify many conditions and set dates for milestones of the purchase

- Once your offer is accepted (hooray!), you then should push to satisfy all the purchase conditions before they expire. This includes getting a mortgage approval

Step 4:

Mortgage approval

This step involves:

Mortgage advisor

Lender

Where can I get a mortgage?

According to CMHC, Canadians get their mortgages by going directly to a bank (60%) or through a mortgage broker (40%). Unlike Realtors, where you have to sign an exclusivity agreement, you don’t need to commit to one mortgage broker or one lender when you’re shopping around for rates. So we encourage you to get different opinions/quotes from brokers and lenders before choosing the person you want to do business with.

It’s worth mentioning how mortgage representatives are incentivized in both options:

- Mortgage brokers: Brokers are only paid a commission by the lender if your deal closes. This typically is around 1% of your mortgage amount. So for example, if your mortgage was $400,000 the mortgage broker would be paid $4,000 by the lender. The only instance where you’d pay for a broker’s services is if they charge a broker fee, which is typically when they aren’t being paid by the lender.

- Lender: The person handling your mortgage is typically a salaried employee that gets paid regardless of if your deal closes or not.

- Rate comparison sites: These websites (unless owned by a lender or brokerage) are just selling your lead to a lender or broker and don’t actually take care of the mortgage for you. They would not count as a mortgage representative, but get paid a flat fee for each lead.

As you can probably imagine, the mortgage broker is highly motivated to ensure your mortgage closes or else they make nothing. This has many benefits in that experienced mortgage professionals will typically leave the lender to be mortgage brokers (you can make a lot more money) and you can receive better/faster service. However, for those that are less ethical it can also create situations where they may not be looking out for your best interest. In asking around for multiple opinions and reading up on them through their past clients, you’ll be able to assess who the credible brokers are.

Who do I pick?

Similarly to Realtors, the barrier to entry is also low and most people typically pick based on a referral from friends and family alone, but you should evaluate your mortgage broker based on:

- Their reputation: This can be evaluated through online reviews; what are their customers saying about them?

- Their brokerage’s reputation: How reputable are they and how long have they been in business?

- Their experience: How long have they been in the industry and what are their credentials? If they’re newer, who is their mentor and what is their mentor’s experience?

- Their license: Get their license number and verify that they’re licensed using the provincial regulator’s website.

Perch perk:

Perch was founded by industry experts and is connected to over 30 lenders to help customers find the best deals. As a Perch user, you have access to our mortgage experts for free, and you can complete the entire mortgage application process online in under 10 minutes. You then receive real-time updates as your mortgage makes it through the various steps.

What is the process to getting a mortgage?

- Your mortgage representative will review your situation (ideally you’ve already gotten pre-approved, so they’re familiar with you) and discuss what mortgage options make the most sense for you

- The mortgage representative will submit your application to the lender

- The lender will then review your deal and issue a commitment letter (if approved), which outlines what conditions need to be met for you to get a mortgage. If your application is rejected, you will need to either revise your application or go to a different lender.

- The mortgage representative will work with you to collect any additional documents to satisfy all of their mortgage commitment conditions well in advance of your closing date (they want to have completed all their requirements at least 10 days prior to your closing date).

- Once most/all of the mortgage representative conditions are met, the lender will then instruct your solicitor.

Step 5:

Solicitor meeting + purchase closing

This step involves:

Solicitor

Lender

Who do I pick?

The barrier to entry for solicitors is high, since they need to have graduated law school and be licensed to practice law. Solicitor costs don’t vary wildly and are typically referred to you by your Realtor or mortgage representative. Ultimately, the main thing you’re looking for is that they are licensed and that their firm has experience handling real estate transactions.

What do I do with my solicitor?

You typically will meet twice with your solicitor. Once the solicitor has received instructions, they will reach out to schedule those appointments.

On your first visit (around 1-2 weeks before your closing date):

- You ask them any questions you have as it relates to the legal side of closing your deal

- They give you an exact breakdown of your total closing costs and down payment, which you will need to bring in as a bank draft bring on your closing date

- Outline any conditions of things you need to do prior to closing (ex: Get property insurance) if any are remaining

- Fill out any required paperwork with you

On your second visit (your closing date):

- You bring in your bank draft for the closing costs and down payment, which they send to the seller’s solicitor.

- They coordinate the transfer of funds between the lender and the seller

- They give you the keys to your new property

Step 6:

What happens after closing

Moving into a new house checklist

- Condos: Make sure you booked your moving elevator well before your closing date

- Hire movers (if required) or book a moving van if you’re doing it yourself. Start collecting cardboard boxes

- Schedule cable, internet and utilities to be set up at your new address after your moving date

- Change the address for everything that’s relevant. This includes things like your ID, mailing addresses, your registered business address (if you’re self-employed), etc.

- Optional: Change the locks on all doors in your new home

- Optional: Deep clean your home so you move in with a fresh start

- Ensure that any service providers or utilities at your old address are deactivated or transferred to the new owner

Congratulations!

It took a lot of work for you to get here! So after you're all settled

in, make sure to put your feet up and enjoy your new home.

Perch perk:

You won’t have to think about any of these things for a while, but within your Perch profile you can:

- See how your property value is performing

- Analyze buying a second property (typically an investment property or cottage)

- Determine the cost of breaking your mortgage early

- Evaluate mortgage renewal options (your mortgage representative will reach out to you prior to your mortgage reaching it’s end)

- Evaluate refinancing your property. This would be if you ever want to pull equity out of your home in order to buy something (ex: renovations, school, etc)