The housing crisis in Canada explained

It’s no secret that there’s something of a housing crisis in Canada. The price of housing in Canada is a hotly debated topic and there’s no official consensus as to the main cause of our expensive real estate market. With that being said, we can take a look at a number of factors which might explain why the Canadian real estate market has trended up over time.

Let’s take a look at the history of real estate prices in Canada and some factors that contribute to our high cost of living in major cities.

The history of Canada’s housing market

A graph of the average home price in Canada looks similar to one of a stock market index. It’s a chart marked by periods of booms and busts, that follow an overall upward trend. It’s clear that a home has been a valuable asset for a long time in Canada, but like any market it’s faced it’s periods of exponential growth and crashes. We’ve currently been in a period of growth for over two decades at this point, and while historians may look to the “2022 Canadian real estate market crash” as the end of a lengthy period of growth, unless there are massive changes in the supply or demand for housing, it’s likely that the overall trend will continue.

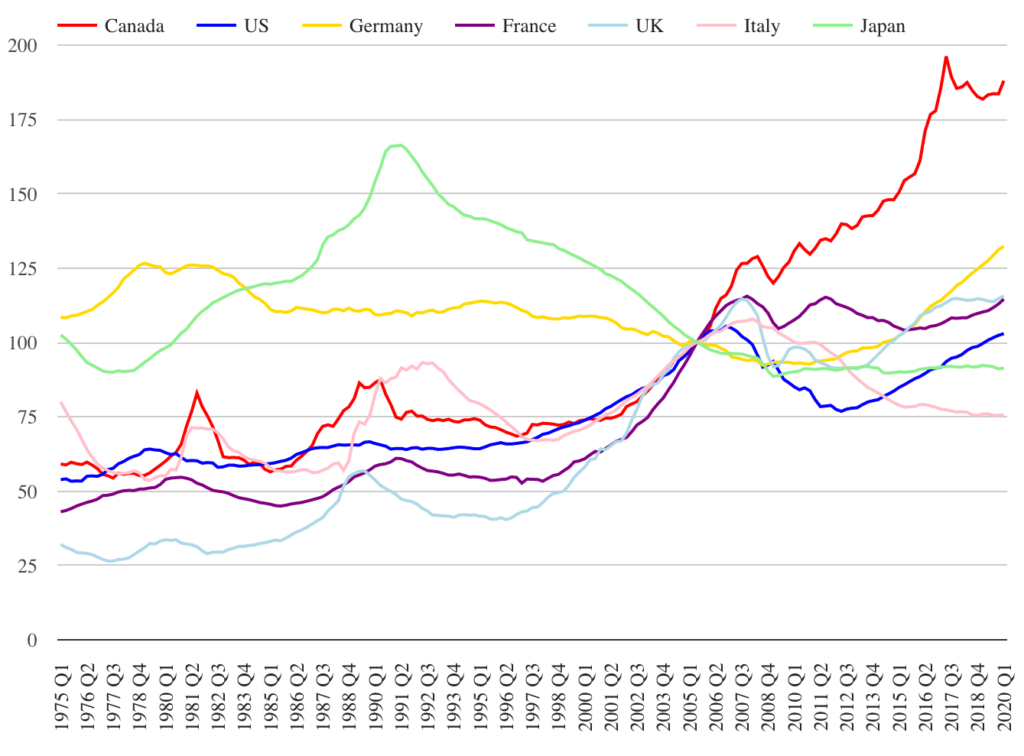

Canada has the lowest amount of housing per capita among the G7, leading to prices increasing in Canada faster than nearly any other country. But a lack of housing isn’t the only factor impacting prices in major cities.

Why are home prices in Canada so expensive?

Like any market, the price of homes in Canada is primarily a function of supply and demand. When the supply for a good is less than the demand for it, buyers bid higher prices to compete with each other, while sellers always want the highest price they can get. When the price for a good increases over time, we can tell that supply is not increasing at a rate high enough to accommodate for the increase in demand.

One of the factors impacting the price of Canadian real estate is that people want to live here. Canada is one of the best places to live in the world, with vibrant diverse cities, beautiful nature, a high standard of living, and a strong job market with plenty of opportunity. Of course when we talk about the housing market in Canada, we are usually referring to a few very specific places. Most people want to live in a large city with access to amenities, infrastructure, and jobs, which is why prices are the highest in Cities like Toronto and Vancouver, which are the most densely populated cities in Canada.

If you look to smaller towns and rural areas, the price of housing takes a sharp decline, where you can buy a similar sized house for a fraction of the price compared to a major city. Even among our major cities there is a large difference in the price of housing, with cities like Edmonton and Winnipeg heaving benchmark prices much lower than the Greater Toronto and Vancouver area. This further illustrates that the price of real estate is influenced by the demand for housing. Prices are higher where people want to live, and when many people want to live in a city where the supply cannot possibly keep up with the demand, the price will increase.

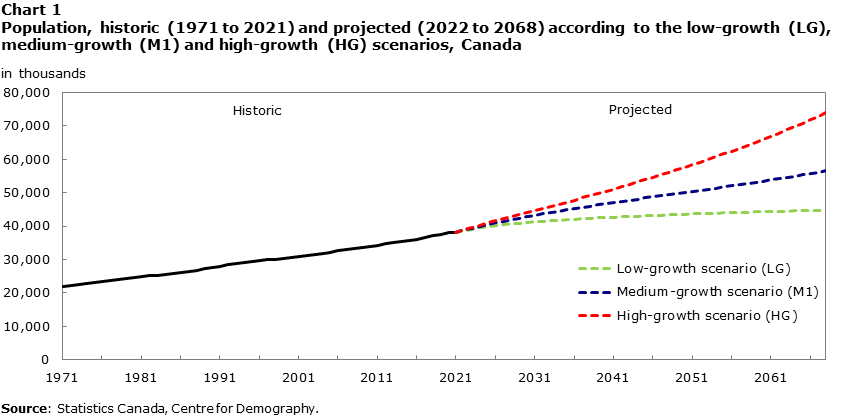

Canada’s population is on the rise

The Canadian government currently permits a large amount of immigration to support our economy and bring in skilled workers. Without any immigration the Canadian population would actually decline slightly each year, as more Canadians pass away than are born. With that in mind, immigration is our main driver of population growth, and it’s no wonder that most newcomers to Canada want to live in the cities with the best infrastructure, community, and job opportunities.

Canada’s population recently grew by just over 1 million people in one year reaching a population growth rate we haven’t seen since 1957. This puts Canada’s estimated population at nearly 40 million with a 2.7% annual population growth rate. At this rate, it would only take 26 years for Canada’s population to double. In the short term, this will add further pressure on housing supply and drive rental prices upward.

Homes aren’t being built fast enough

According to a report by Scotiabank, Canada has the largest housing deficit among the G7, representing a “structural housing shortage”. We simply have a shortage of homes in our major cities. We’re also dealing with a shortage of trade workers that means even if regulatory slowdowns and contract disputes weren’t an issue, it takes significant time to build new housing in Canada.

Recommended reading: How population affects the housing market.

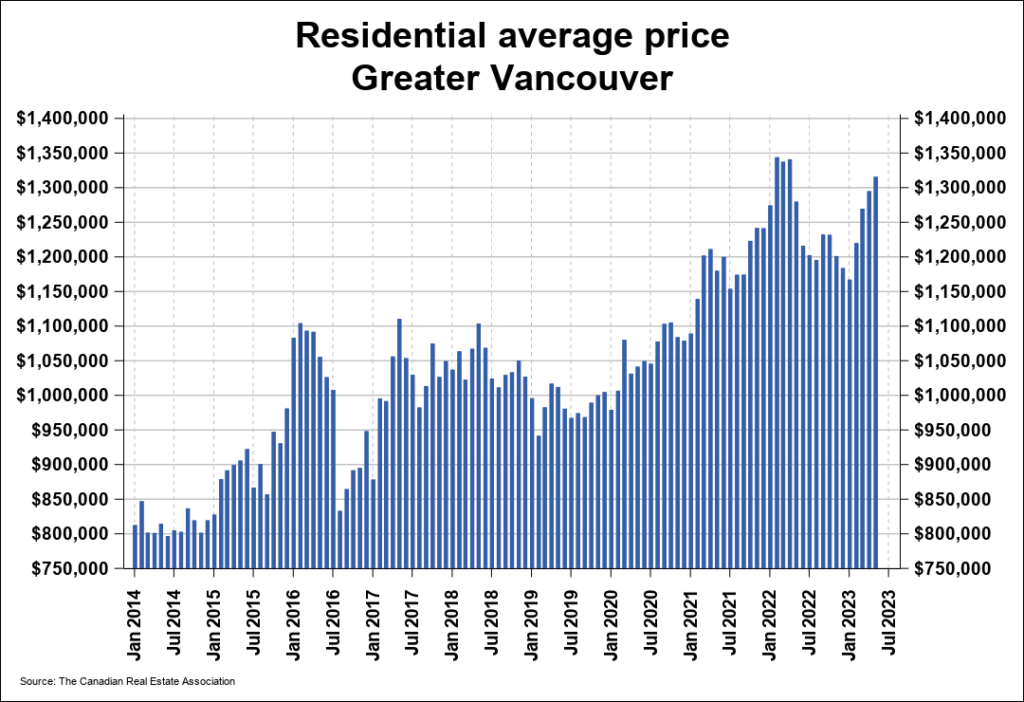

Housing prices in Vancouver

In Vancouver, the supply of housing is limited by the city’s natural features, being locked in by mountains and the Atlantic Ocean. The ability to build new housing is restricted due to the geographic location of Vancouver. The best option for Vancouver to increase its supply of housing is to build denser housing like high-rise condos. It goes without saying that the supply of new housing hasn’t outpaced the demand to live in one of the most beautiful cities in the world.

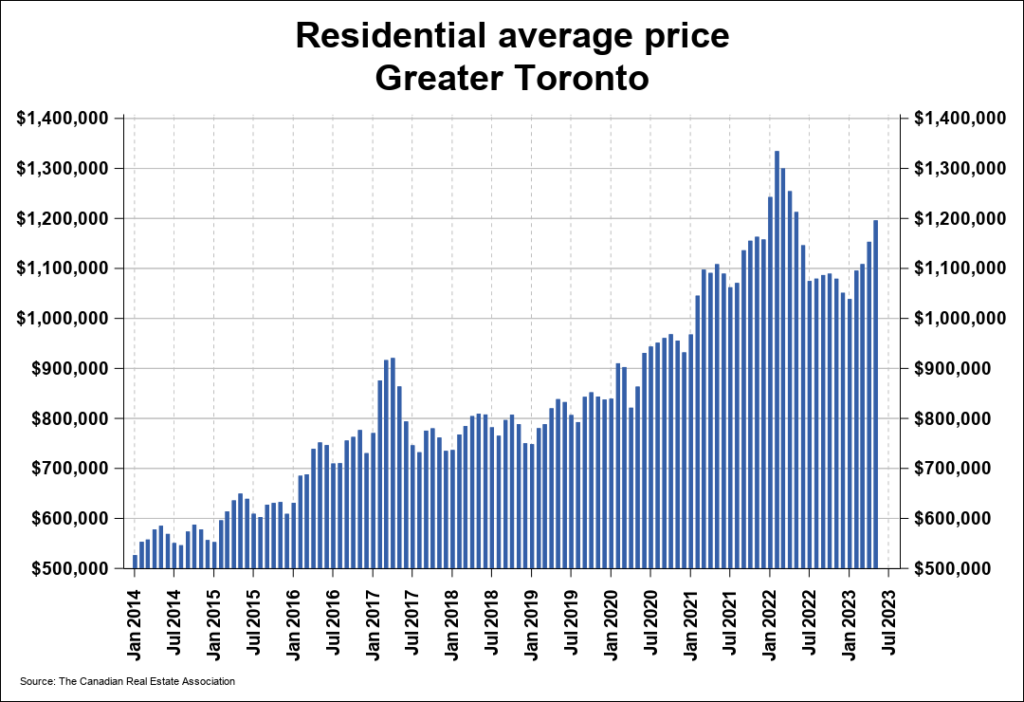

Housing prices in Toronto

In Toronto, urban sprawl has helped keep the benchmark price below that of Vancouver, while also having a stronger job market with more opportunities, but that too has its limits. The price of cities adjacent to Toronto and elsewhere in the GTA and Southern Ontario is similarly expensive compared to elsewhere in Canada. What this tells us is that even un-restricted by geographic factors like in Vancouver, it is still possible for the demand for housing to outpace supply. It takes time to build homes, especially with a shortage of trade workers, and there is an entire world of building permits and construction deals that we could delve into that limits the rate that new homes are built at.

With the housing market as it is, the last thing you want to do is leave money on the table when it comes to your mortgage. Shopping mortgage offers from multiple lenders with an online mortgage broker like Perch can save you thousands.

Alex

Alex