Here’s why the Canadian housing market isn’t a bubble imminent for collapse.

Let’s take a deep dive into the reasons some are calling for the bubble to burst, and how it doesn’t seem likely given our current climate.

Key Takeaways

- The amount of mortgage holders late on their payments remains low

- Our latest interest rate forecast predicts that the Bank of Canada isn’t likely to raise rates for the rest of 2023.

- Demand for homes is on the rise, driven by population growth, while supply is struggling to keep up.

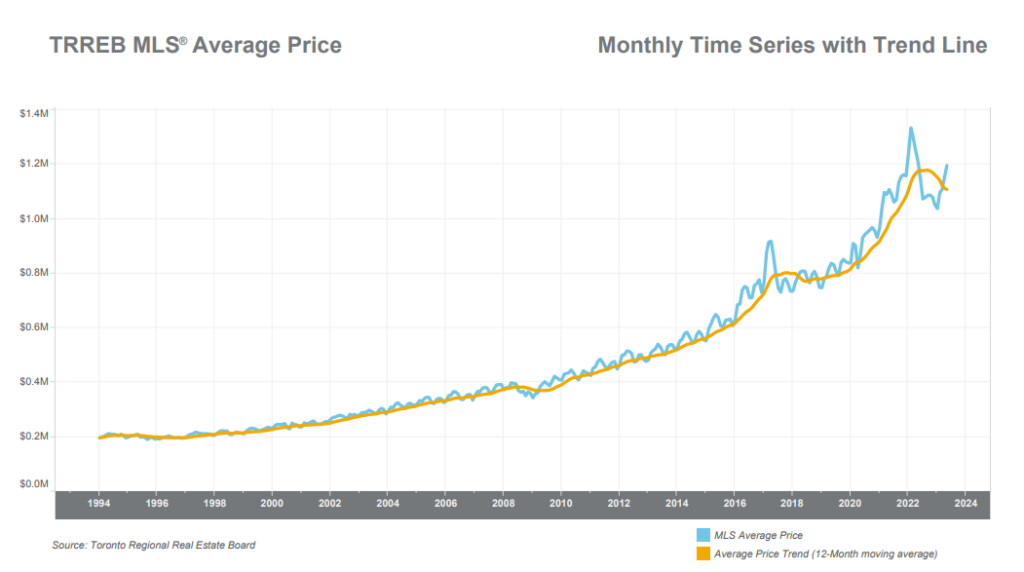

There’s no doubt that there’s an affordability crisis in the Canadian housing market, with the price of homes in southern Ontario and British Columbia rapidly outpacing wage growth over the past few decades. Both home prices and the cost of rent have seen massive increases in recent years with the average price of a home in Canada reaching $709,000 in June 2023, up from $455,000 in October 2015, according to CREA.

Despite this, a lack of affordable housing in some regions of the country isn’t necessarily proof that we’re in the “largest housing bubble of all time” as some online have started to claim.

With the most provocative message often driving the most engagement online, we’ve seen an increase in people warning of an imminent “doomsday” in the housing market which would see prices collapse from their current highs. This is already misleading as the market dropped some 10% across the board in 2022, and closer to 20% in regions with the highest prices like the Greater Toronto and Greater Vancouver areas. Following the Bank of Canada slowing their aggressive interest rate hikes, a lack of supply has already begun to catch up with the market, causing prices to rebound in some areas.

Is the Canadian housing market a bubble waiting to burst?

The main argument in favour of a housing “crash” seems to be a combination of record levels of debt combined with rising interest rates. The thinking is this would lead homeowners to be unable to afford their mortgage and having to default, which would result in the foreclosure and sale of their home.

In theory, this would lead to a flood of new inventory on the market causing a decrease in prices. Proponents of this theory cite statistics like the record household debt in Canada, and decreasing affordability in the mortgage market, citing rising interest rates, and anecdotal evidence of homeowners stretching their budget to afford their mortgage with methods like a longer amortization period.

Canadians aren’t losing their homes

For those looking to get into the real estate market, an imminent collapse in the price of housing may seem alluring. However, data suggests this scenario is rather unlikely to happen.

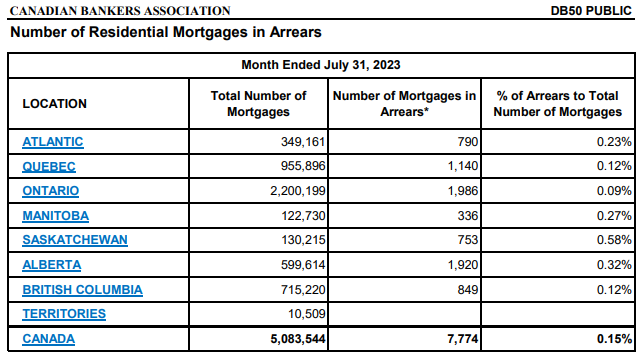

According to data from the Canadian Bankers Association, as of June 2023, only 0.15% of Canadian mortgages are late on their payments, dropping to 0.08% in Ontario where real estate prices are among the highest. In comparison, during the subprime mortgage crisis of 2008 in the United States, 9.2% of mortgages were late on their payment or defaulted, increasing to 14.4% at the height of the collapse.

In order to reach similar rates of mortgage delinquency, the number of mortgages in arrears would need to increase by 6100%. Even if we assume that the 0.5% increase in rates we’ve seen since June 2023 has doubled the amount of mortgage holders late on their payments, we’re far from seeing massive amounts of mortgage defaults that would bring prices down anywhere close to what could be considered the bursting of a bubble.

Interest rates aren’t likely to rise for much longer

When it comes to the possibility of interest rates continuing to rise, the narrative begins to unravel even further. Most analysts are predicting that the most recent pause on rate hikes by the Bank of Canada is likely to signal that the current period of rising interest rates is coming to an end. Inflation has been slowing throughout 2023 and the economy is showing weakness which could lead to the Bank of Canada beginning to cut rates as early as the second half of 2024.

Our own analysts are predicting that the Bank of Canada will hold rates steady through the end of the year, followed by potential rate cuts in 2024. In order for the housing market to face a serious drop we’d likely need to see interest rates continue to rapidly increase like they did in 2022 leading to the last decrease in prices which seems extremely unlikely.

Demand is outpacing supply

Interest rates aren’t the only factor impacting the housing market, and when you take them out of the equation the main driver of increasing prices must be the intersection of supply and demand.

Canada’s population is increasing at record levels, with over 1.2 million new Canadians added to the count in the past year. Our population is on track to increase by a similar amount in 2024, and the government hasn’t shown any signs that may indicate a change in their policy on the matter. The result of this rapid growth combined with supply not increasing at a pace to sustain that level of growth is that Canada has the lowest number of homes per 1000 residents among the G7.

Recommended reading: How does immigration affect the housing market?

The Canadian Mortgage and Housing Corporation (CMHC) released a report stating that under current projected population growth models, Canada would need to make up for a shortfall of 3.5 million units on top of what is already being built in order to restore affordability in the housing market. This shortfall increased to over 4 million in the event that the government pursued an even more aggressive immigration policy.

For reference, the CMHC lists Ontario as having just over 6 million units of housing as of 2023. There doesn’t seem to be any indication that either the government will slow the rate of population growth or that we’ll be able to build the equivalent of another Greater Toronto Area in the next 6 years.

The housing market will keep going up

Whether or not the Canadian housing market is a “bubble” will be determined by whether the rapid increase in prices is followed by an even quicker decrease. Due to the current interest rate forecast and the systemic lack of supply in the housing market that isn’t showing any signs of improving, we see a high likelihood that housing prices will continue to rise in the future without a large crash any time soon.

Perch is your digital mortgage brokerage, offering you the opportunity to search and compare mortgages, then get pre-approved in as little as 20 minutes. Think of us as Google Flights, but for your mortgage.

When you sign-up to Perch you get instant access to our Pathfinder tool, which will show you mortgage options from dozens of lenders.

Our mortgage advisors have years of experience in the mortgage industry, and can help you choose the best mortgage for your situation, so you don’t have to worry about leaving money on the table.