Read the February 2023 Canada interest rate forecast.

Read the April 2023 Canada interest rate forecast.

Latest Mortgage Rate Outlook in Canada for March 2023

With the Bank of Canada announcing a 25 basis point increase for interest rates in January, the question on most mortgage holders and would-be buyers is are there any more rate hikes in store for us in 2023. “With the Bank of Canada increasingly signaling that rates are now at the top, it’s possible the spring market this year could also surprise, particularly in areas where prices have been stable or are now stabilizing.” Said CREA’s senior economist Shaun Cathcart. The Bank of Canada will be looking closely at economic data to determine whether or not they need to increase rates again to curb inflation, with emphasis on the labour market, CPI, and GDP. Let’s take a look at how the mortgage market is trending going into March.

The current policy interest rate

On January 25th, the Bank of Canada raised its policy interest rate for the 8th consecutive time. The current policy interest rate is 4.50%, with Lender prime rate being 6.70% the impact of higher cost of borrowing has weighed down on consumers and businesses alike, thankfully, signs of relief are ahead as the central bank will likely move to pause further rate hikes at the next Bank of Canada meeting which is slated for March 8.

How is the mortgage market trending?

For the month of March, we anticipate fixed rates will rise, variable rates will remain the same as the Bank of Canada will potentially halt further rate hikes on March 8. According to CREA, sales activity in January was down 3% month over month and hit a 14 year low nationally. Coming off of a lowest new supply recorded ever for a December, January saw a 3.3% month over month increase in supply, an uptick we had anticipated in our February forecast.

In February, we saw optimistic economic data that have delayed the pace of anticipated rate cuts from the Bank of Canada. The long term interest rate outlook has reverted back to 4.00% as of our March outlook and a steadier decline in inflation than initially projected in January has led to a modest rise in fixed mortgage rates.

If you’re wondering why variable rates are now trending higher than fixed rates check out this article for a more in depth overview.

The Canadian economy has slowed...

According to Statistics Canada Real GDP edged down in December (0.1% month over month). Services-producing industries remained unchanged (0.0%) while partially offset by a decline in goods-producing industries (-0.6%), contributing to an end of five consecutive quarters of growth and an annual GDP of 3.6%. The bank of Canada, in its January monetary policy report estimates GDP will grow by only 1% annually for 2023.

… and so has inflation

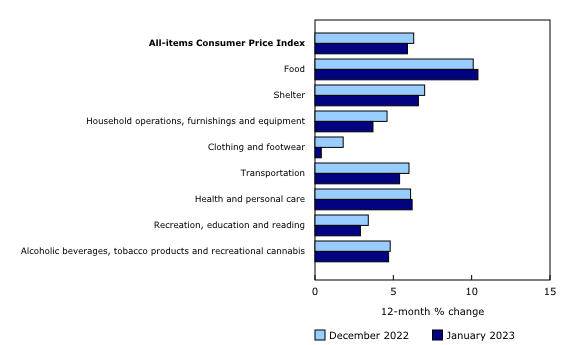

Following a 6.3% year over year increase in December, as we predicted in our February forecast, the Consumer Price Index (CPI) rose 5.9 % year over year in the month of January, entering sub 6% territory for the first time since February 2022. Excluding food and energy, prices increased 4.9 % year over year and 5.4% when excluding mortgage interest cost. Rising mortgage interest rates continue to put upward pressure on the CPI, with the mortgage interest cost index rising 21.2% year-over-year, following an 18% increase in December, Canadians have not seen an annual increase of this size since 1982. The Bank of Canada has now revised their inflation outlook to 3% by mid 2023. We expect the CPI to continue its downward trend in February, those numbers will be available on March 21st.

Unemployment remains low

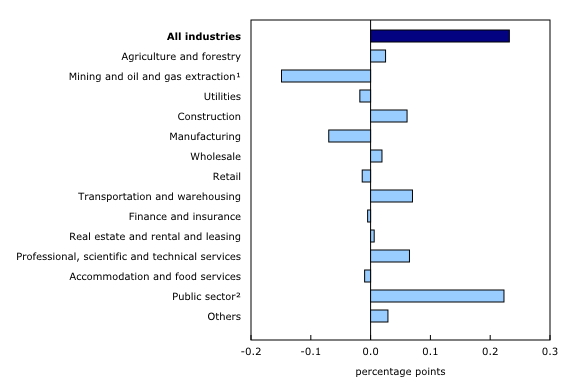

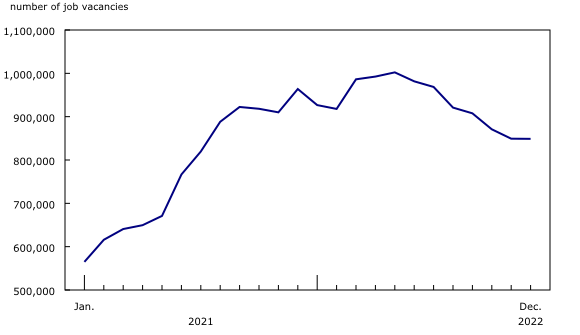

Job vacancies remained unchanged in 14 of 20 sectors during December, overall, the number of job vacancies across all sectors decreased by .05% month over month with 1.2 unemployed persons for every job vacancy, essentially unchanged since August, but up slightly from the low of 1.0 in June. Prior to the pandemic, the unemployment-to-job vacancy ratio ranged from 1.9 to 3.1.

In January, employment numbers crushed expectations with Canada adding 150,000 new jobs, versus the expected 15,000. The unemployment rate remained unchanged at 5.0%, slightly higher than the record low of 4.9% reached in July. The bank of Canada wants to see the unemployment rate trend higher and closer to 6% as a sign of a loosening labour market, however as we’ve seen inflation continue to trend downwards, the unemployment rate has relatively remained unchanged.

Wages are up but lag behind inflation

All provinces mostly recorded year-over-year growth in average weekly earnings. Average weekly earnings grew 3.4% year-over-year in December, down from November (4.0%), a welcomed drop by the Canadian Central Bank. Wage growth is an indicator that has been a sticking point for the Central Bank and slowing wages will further rally support for their decision to pause rate hikes as inflation has tampered significantly since mid 2022.

Canada’s population is growing faster than ever

Canada’s population is growing faster than ever before, and it’s all thanks to immigration. According to Statistics Canada, as of October 2022, 362,453 people have immigrated to Canada since July 1, 2022, an increase of 0.9%, marking the highest quarterly population growth rate since the second quarter of 1957 (1.2%). While most of the third quarter population growth numbers were driven by an increase of 225,198 non-permanent residents who were already here on work permits, this increase in one quarter was larger than any full-year increase since 1971.

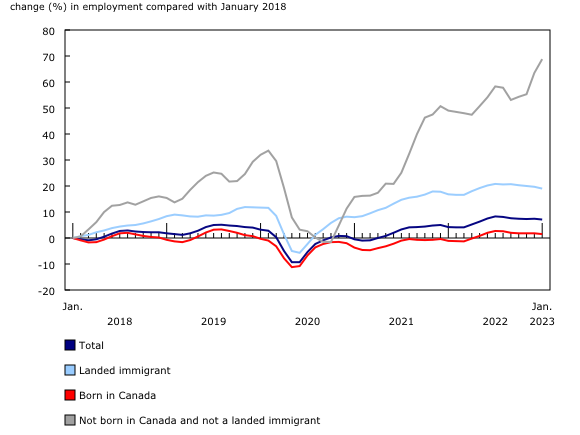

According to Stats Canada, employment is rising fastest in group that includes non-permanent residents, up 13.3% (79,000) in January, this sector of the population accounted for 3.4% of total employment, up from 3.1% year over year. Adding further pressure on housing supply and driving the rental market upward in lieu of.

Bond yields jump

Markets welcomed bond yield levels not seen since August of 2022 during the months of January and February, however it was short lived as we saw the 5 year bond yield rise sharply to near highs on news of strong labour market and lower than expected unemployment rates. “The rise in yields reflects a run of solid economic data in both economies, and the dawning realization that central banks may need to do even more than expected just a few short weeks ago.” explained Douglas Porter, Chief Economist at BMO.

Is now the right time to buy a home?

With rates possibly peaking and the housing market down across the board in cities, now might be the time to jump on the homeownership bandwagon if you’ve been waiting on the sidelines.

When interest rates eventually come down again it’s likely the increased demand will bring the housing market back to where it was pre 2022. If you go with a variable rate you could have the best of both worlds when rates come back down, or you could play it safe and go with a fixed rate mortgage.

Our current best 5-year fixed rates is 4.67% and 5-year variable rate of 5.60%. For first-time home buyers, there are some great opportunities in a market dampened by negative sentiment and overall lack of competition, especially as new inventory begins to trickle in ahead of the spring market. For homeowners who are coming up for renewal, continue to monitor our rate forecasts, it would be wise to see what rates Perch may be able to offer above and beyond your existing Lender, as they’re typically less aggressive on their rate offerings. For homeowners who would like to see the benefit of switching lenders and breaking their mortgage early, Perch automatically calculates the net benefit once you input your existing property and mortgage details in your Perch portfolio.

Ali

Ali