Read the 2024 interest rate forecast.

Save money on your mortgage

Don’t leave money on the table

Don’t just go with your bank

Get today’s best rates from our lenders

On March 6th, The Bank of Canada published their decision to continue to hold their Policy interest rate at 5%. With 5 consecutive rate holds, markets and the Central Bank are convinced there’s clear evidence pointing to slowing demand and an economy in modest excess supply, lead by slower consumption growth and a decline in housing activity. Markets and Senior Economists are largely convinced there are no more rate hikes in the pipeline for Canadians and expect two 0.25% cuts to occur in the second half of this year and cumulative cuts of 2% by the end of 2026. The Central Bank projects the economy will continue to cool down, bringing inflation close to 3% during the first half of this year before gradually easing. The Bank of Canada will be publishing their Interest rate announcement and Monetary Policy Report on their third meeting of 2024, on April 10th.

Commentary from Perch’s CEO and Principal Mortgage Broker, Alex Leduc:

January through March of this year has been relatively constant. The market currently expects two 0.25% cuts to occur in the second half of this year and cumulative cuts of 2% by the end of 2026.

Key Takeaways

- The Bank of Canada has paused rate hikes for the time being, with the next announcement scheduled for April 10th.

- For the month of April, we anticipate fixed rates will continue to drop and variable rates will remain the same.

- Today’s best mortgage rates are 4.74% for 5-year fixed and 6.10% for 5-year variable.

- For first-time home buyers, there are some great opportunities, sellers are coming to terms with tapering price growth as higher interest rates have barred many from entering the market, inventory is low, but will edge up in the early months of 2024, before really ramping up in the Summer.

- For homeowners who are coming up for renewal, continue to monitor our rate forecasts, it would be wise to see what rates Perch may be able to offer above and beyond your existing Lender, as they’re typically less aggressive on their rate offerings.

- For homeowners who would like to see the benefit of switching lenders and breaking their mortgage early, Perch automatically calculates the net benefit once you input your existing property and mortgage details in your Perch portfolio.

What’s new in the mortgage world this month?

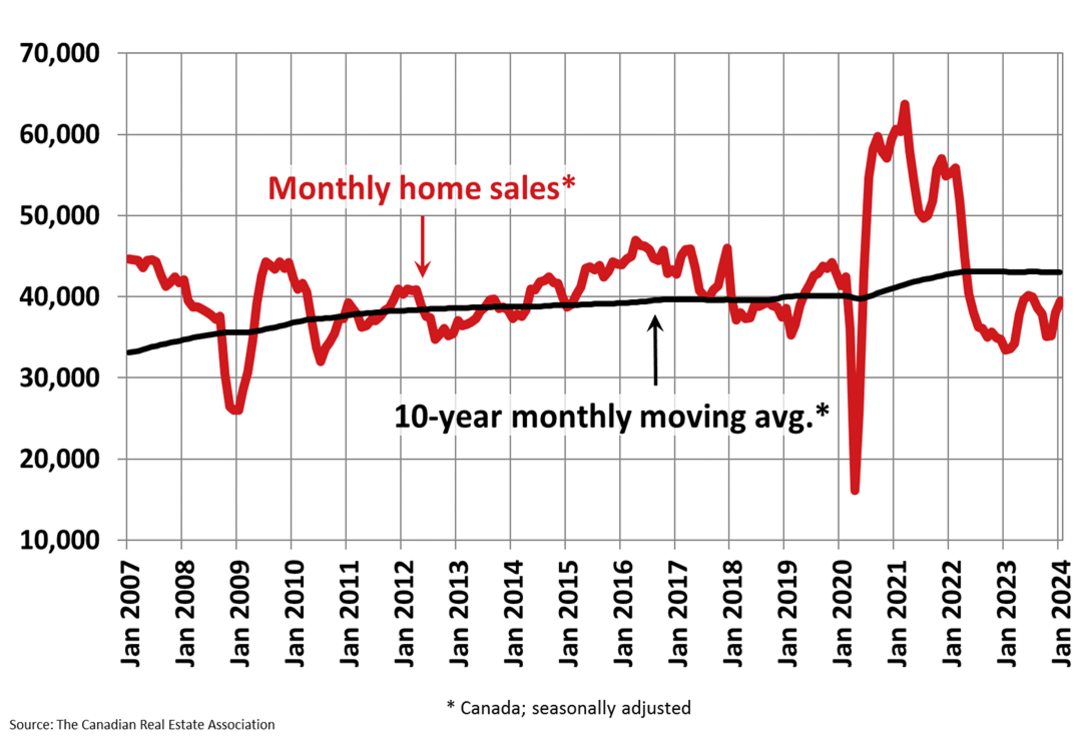

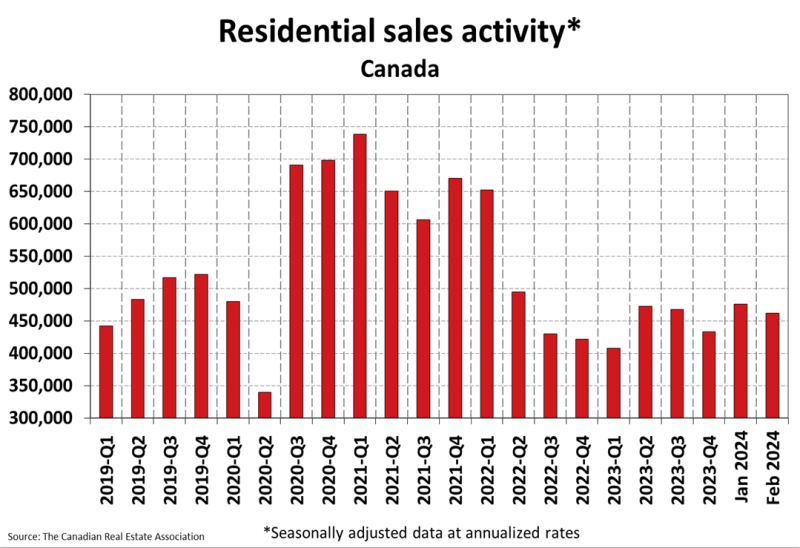

For the month of April, we anticipate fixed rates will continue to decrease and variable rates will remain the same. National sales activity dropped by 3.1% in February after climbing 12.4% since December, however, sales in February were still 5% below the 10-year average. On a year over year basis, February 2024 sales activity is up 19.7% from one of the worst February data recorded in the past two decades.

Canada’s inventory edged up by 1.6%, nowhere near inventory levels we’ve seen in the middle of 2023, thus, the sales-to-new listings ratio edged down to 56.6% in February, down from 58.8% in January, in comparison, this ratio peaked at 67.9% in April 2023. According to CREA, a ratio between 45% and 65% is generally consistent with a balanced housing market. “It’s looking like February may end up being the last relatively uneventful month of the year as far as the 2024 housing story goes,” said Shaun Cathcart, CREA’s Senior Economist. “With so much demand having piled up on the sidelines, the story will likely be less about the exact timing of interest rate cuts and more about how many homes come up for sale this year.” explained further Shaun Cathcart.

The Bank of Canada is continuing to hold interest rates steady

On March 6th, The Bank of Canada published their decision to continue to hold their Policy interest rate at 5%. With 5 consecutive rate holds, markets and the Central Bank are convinced there’s clear evidence pointing to slowing demand and an economy in modest excess supply, lead by slower consumption growth and a decline in housing activity. Markets and Senior Economists are largely convinced there are no more rate hikes in the pipeline for Canadians and expect two 0.25% cuts to occur in the second half of this year and cumulative cuts of 2% by the end of 2026. The Central Bank projects the economy will continue to cool down, bringing inflation close to 3% during the first half of this year before gradually easing. The Bank of Canada will be publishing their Interest rate announcement and Monetary Policy Report on their third meeting of 2024, on April 10th.

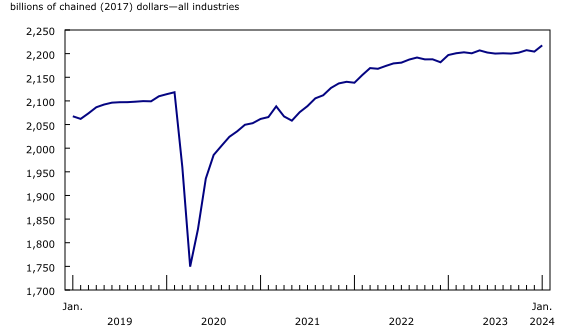

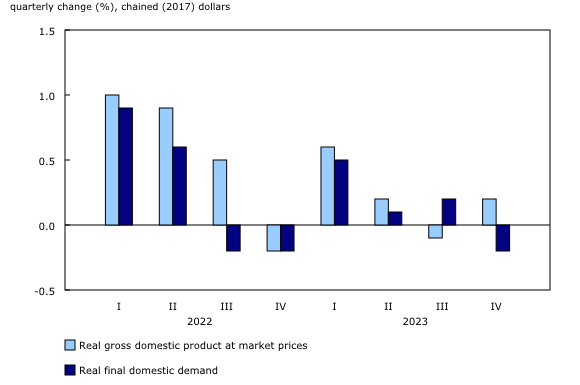

The strength of the Canadian economy

Canada’s real gross domestic product grew by 0.6% in January with broad-based growth in 18 of 20 sectors. After edging up 0.2% in the fourth quarter on the back of higher exports of crude oil and crude bitumen (+6.2%), as well as reduced imports, following a decline of 0.1% in the third quarter. According to Statistics Canada, “The lower growth in the fourth quarter of 2023 reflected slower wage growth in services producing industries relative to the previous quarter, as well as declining wages in the goods-producing industries”.

Q4 negative GDP data released on February 29th shows that on an annualized basis, the Canadian economy grew at a rate of 1.1%. “Growth appears to have been driven largely by an easing of previous supply constraints helping exports and car sales, rather than necessarily an improvement in domestic demand,” Andrew Grantham, an economist at CIBC Capital Markets, said.

While this technically means Canada is not yet in a recession, as we have not yet had two consecutive contracting quarters, growth stalled, remaining essentially unchanged and coming in below expectations for the year. The central Bank forecasts GDP growth of 0.8% in 2024 and 2.4% in 2025.

Key Terms:

GDP: GDP or Gross Domestic Product refers to the total dollar amount of goods and services produced in a country. It is an overall measure of the strength of our economy.

CPI: The CPI or Consumer Price Index is a measure of inflation tracked by Statistics Canada. It attempts to track the spending habits of the average consumer with a basket of typical goods and services.

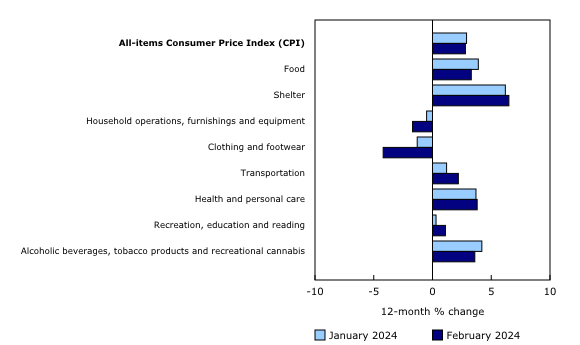

Consumer price index (CPI)

February consumer price index, the measure for year over year inflation, came in at +2.8%, following January’s +2.9%. Excluding gasoline, the headline CPI slowed year over year, to 2.9% in February from 3.2% in January. Canadians continued to battle elevated shelter costs in February (+6.5%), with the largest contributor being mortgage interest costs (+26.3%), notably, mortgage interest rates has been and continues to apply the highest upward pressure on the CPI since December of 2022. The Central Bank sees tightening household discretionary spending as their most viable tool to halt consumer spending on goods and services and attain their 2% inflation target, the CPI dropped below the 3% mark as we predicted in our previous monthly report, we’re expecting further drops until the 2% mark is reached around May, after which the Bank of Canada may need to move quickly to avoid a deflationary scenario, the next slated CPI announcement will be on April 16th.

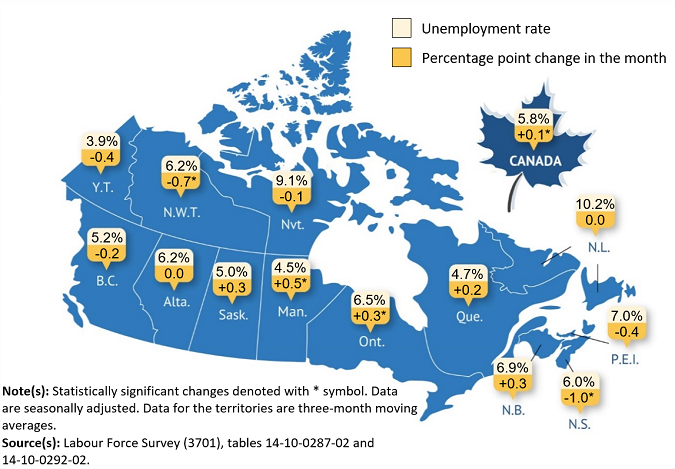

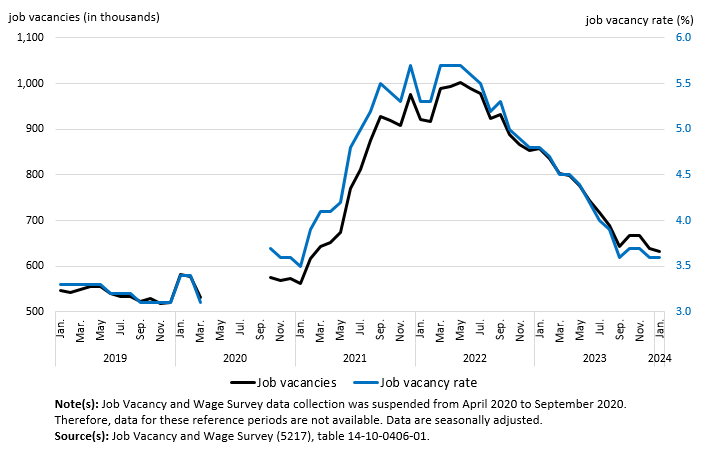

Job vacancies and Unemployment Rates

Job vacancies continued to fall in the fourth quarter of 2023 (-3.6%), following six consecutive quarterly declines since the highest recorded number of vacancies back in the second quarter of 2022. There were 1.8 unemployed persons for every job vacancy in the fourth quarter of 2023, up from 1.7% in the previous quarter, indicating the labour market tightness has eased, which will potentially reduce upward pressure on wage growth.

Strong population growth continues to fuel demand

Canada’s population saw an annual increase of 1,271,872 (+3.2%) people between January 1, 2023 and January 1, 2024, marking the highest growth rate Canada has seen since 1957. Strong population growth continues to add both demand and supply to the Canadian economy, newcomers are helping ease the shortage of part time workers while also boosting consumer spending and driving up demand for shelter. Ottawa plans to level out the number of new immigrants it accepts in 2026, however will maintain their goal of attracting 500,000 newcomers annually in both 2024 and 2025. Many arriving in Canada’s major markets are searching for shelter amidst the home unaffordability crisis, driving up rental cost (+8.2%) in February. Provinces rely heavily on Canadian investors to supply rental apartments in the form of investment homes, however, as higher interest rates and mortgage costs have worked to deter existing and would be landlords, the supply of rentals has steadily declined which has driven up rents across the country.

Recommended reading: How does population affect the housing market?

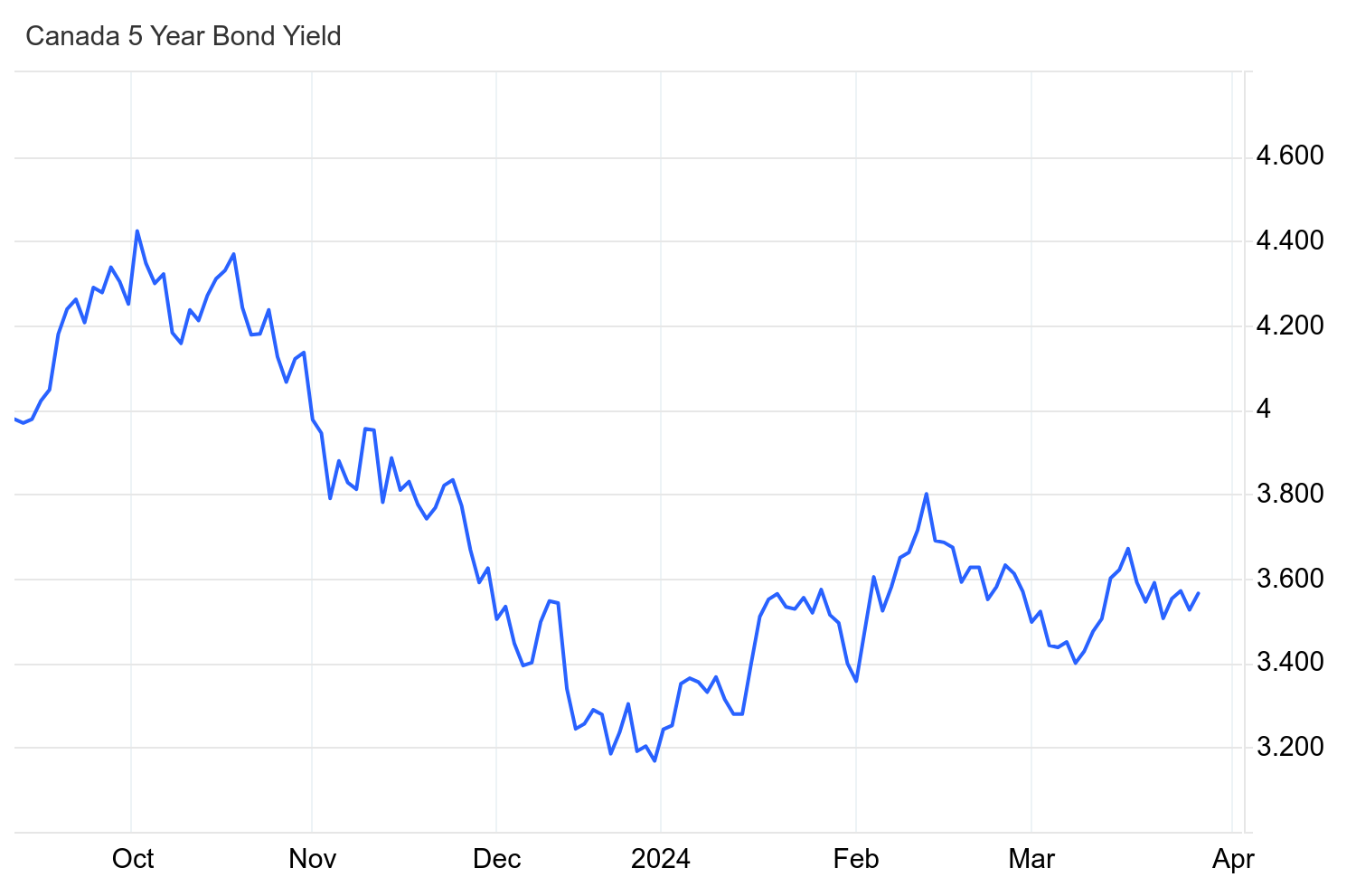

Bond yields move downwards

Canada’s 5-year bond yields have continued to move downward since they reached 16-year highs during the month of October. Canada’s mortgage rates tend to track five-year bond yields at a premium and with a lag. Yields dropped due to a growing consensus that interest rates remaining elevated long than anticipated and a hard Canadian recession fear all but diminished as the Canadian economy is now expected to be in a mild recession after a negative Q3 and flat Q4 results.

If you’re looking to buy a home in Canada:

Our current best 5-year fixed rates is 4.74% and 5-year variable rate of 6.10%.

For first-time home buyers, there are some great opportunities, sellers are coming to terms with tapering price growth as higher interest rates have barred many from entering the market, inventory is low, but will edge up in the early months of 2024, before really ramping up in the Summer.

For homeowners who are coming up for a mortgage renewal, continue to monitor our rate forecasts, it would be wise to see what rates Perch may be able to offer above and beyond your existing Lender, as they’re typically less aggressive on their rate offerings.

For homeowners who would like to see the benefit of switching lenders and breaking their mortgage early, Perch automatically calculates the net benefit once you input your existing property and mortgage details in your Perch portfolio.

Ali

Ali