Is everything we know about saving for retirement wrong?

When someone asks for financial advice, you can almost guarantee the responses will include investing in real estate and saving for retirement. Conventional wisdom states that owning a home and paying off your mortgage quickly are critically important in achieving stability and maintaining financial health in retirement. That’s good advice! But is it always best to pay off your mortgage as quickly as possible?

Let’s took a closer look at this assumption to see if there are better options that create more value. Specifically, we’ll look at how large a retirement nest egg is saved leading up into retirement, the ability for someone to retire comfortably and what the impact on their estate planning.

Key Takeaways

- Conventional advice is to pay off your mortgage as quickly as possible framing “leverage” as bad, but this isn’t always the case.

- By refinancing and investing your home equity it’s possible to end up with a higher net worth and more liquid assets.

- A reverse mortgage could leave you with significantly less assets during retirement than a scenario where you took out home equity to fund other investments.

Meet Pat:

Current Details

- Age: 35 years old

- Location: Lives in Ottawa, Ontario

- Income: $100,000 annual gross income. Assume that his wages grow by 3.00% each year.

- Expenses: $3,000 monthly expenses excluding housing costs (things like a car, groceries, utilities, etc). Assume these grow by 3.50% each year

- First-time home buyer

Retirement Details

- Wants to retire at 65

- Assume he will live to 85

Returns

- Property appreciates 6% per year (below the 20 year average of 7.5%)

- Investments generate 8.50% returns leading up to retirement and generate 5.50% in retirement as a result of a shift to lower risk assets with a shorter time horizon.

Time Value of Money

To make the figures more relatable, any future values (net worth, assets, retirement expenses, etc) are in present value terms.

This means “in today’s dollars”, adjusted for inflation.Pat is about to buy his first home today and chooses a 5-year term, with a 25-year amortization and 5.50% fixed rate mortgage.

Part 1: The Build Up to Retirement

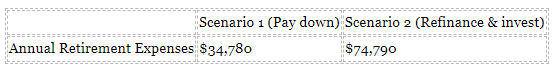

Scenario 1: Pay down your mortgage as fast as possible and then start saving

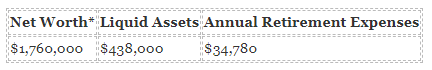

Now that Pat has a mortgage, he begins to take advantage of his prepayment privileges by contributing any extra savings each month towards paying down his mortgage as quickly as possible. At the end of his mortgage term, he renews into a fixed rate and continues making prepayments, repeating this process until he eventually pays off his mortgage early. This is expected to happen when Pat is 50 years old, so he’d pay off his 25 year amortization mortgage in 15 years. Now that he owns his home outright and no longer has any mortgage payments, he starts investing his monthly savings towards his retirement nest-egg until he retires at 65. Here’s a summary of what Pat’s retirement situation looks like once he reaches 65:

*Net worth is the sum of all assets (property and investments) minus the sum of all debts (mortgage)

Scenario 2: Make regular mortgage payments and reinvest home equity

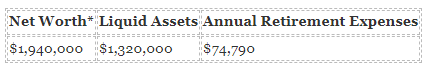

In contrast to Scenario 1, instead of paying off his mortgage earlier with extra prepayments, Pat only makes the regular mortgage payment. With his excess savings each month, Pat invests it. At the end of his 5-year term, Pat decides to refinance instead of renewing his mortgage to pull out all the available equity in his home.

What does he do with the additional cash from his refinance? You guessed it: he invests for retirement. Pat repeats this process at the end of each 5-year term, repeatedly refinancing and investing the equity take out until he retires. Here’s a summary of what Pat’s retirement situation:

*Net worth is the sum of all assets (property and investments) minus the sum of all debts (mortgage)

The Results:

If this seems counterintuitive to what you’ve been told, you’re not alone.

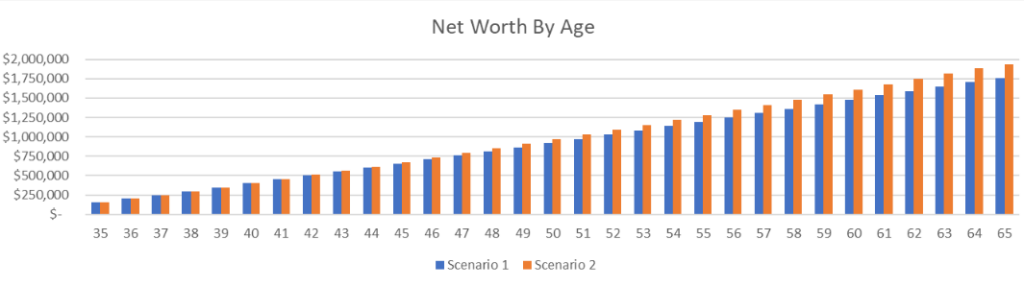

So how does Pat end up with a larger nest egg in Scenario 2? The difference is the strategic utilization of his home equity. As the value of his property increases (and the balance of his mortgage decreases), he unlocks this value with a mortgage rate that is lower than the return he’d expect to make on investments. Put simply, Pat doesn’t benefit from saving 5.50% on his mortgage when he could’ve been making 8.50% on investments and that compounds over time.

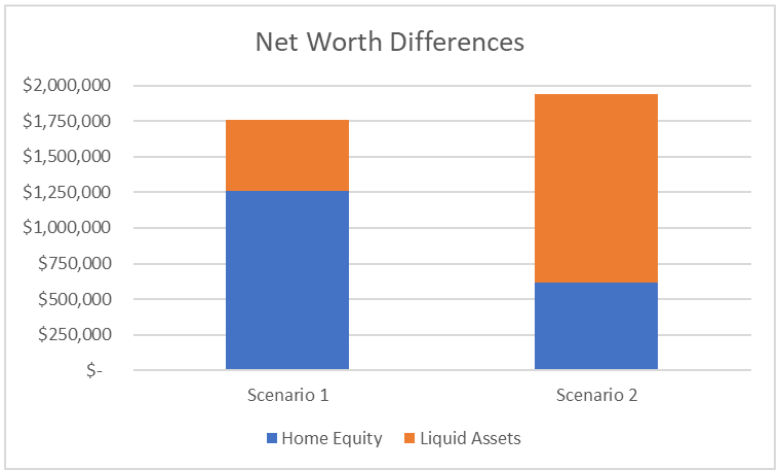

In addition to building more net worth, Pat is diversifying his assets. With $1,320,000 in liquid assets versus $438,000, 32% of his net worth is tied up in his home rather than 75% in Scenario 1.

This matters a lot in retirement for a few reasons:

- Pat can’t pay for his groceries with home equity. Liquid assets are easily convertible to cash and is what Pat will need to finance his retirement and cover his expenses.

- Being heavily concentrated in real estate means that Pat’s net worth is predominantly tied to his property’s value. If the housing market were to swing negatively, he has no diversification and could see a substantial reduction in his assets.

Cashflow

In Scenario 2, Pat has financed buying the additional $882,000 in liquid assets with a higher mortgage balance. As a result, Pat will need to either draw down from assets or maintain a larger income in order to service a larger mortgage balance each time he qualifies.

It’s worth noting that qualifying for a higher mortgage amount is by no means guaranteed. However, when people wait until retirement to qualify for a mortgage their qualifying income is almost always lower than before retirement and the amount of mortgage they can qualify for will also be lower as a result.

Part 2: The Wind Down In Retirement

By 65, Pat has put in his time at work, toasted some champagne at his retirement party and is ready to retire! Let’s take a look at how Pat’s life in retirement will differ under each scenario.

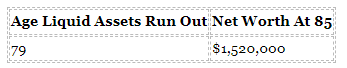

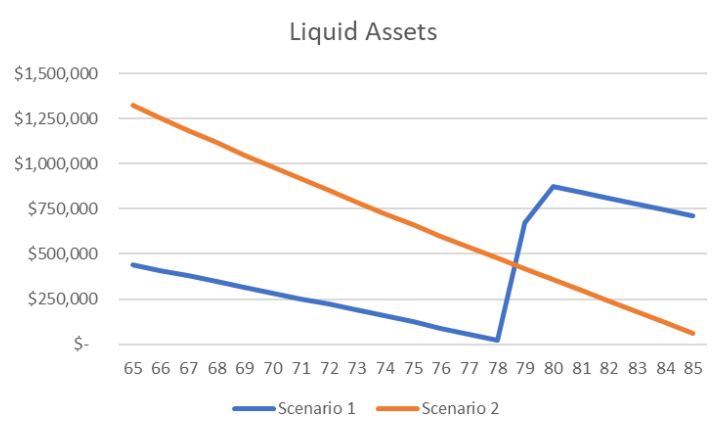

Scenario 1: Pay down your mortgage early, then start saving

Pat starts to draw down on his liquid assets to fund his retirement. He would run out of money just before his 80th birthday, roughly 14 years into his 20 year retirement. To plug the gap, Pat would take out a 9.50% rate reverse mortgage on his home. The funds from the reverse mortgage then enable Pat to fund the rest of his retirement.

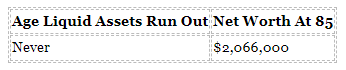

Scenario 2: Make regular mortgage payments and reinvest home equity

Pat starts to draw down on his assets to fund his retirement. He would not run out of money during his retirement.

The Results

In Scenario 2, Pat will have substantially more liquid assets, but they will deplete at a faster rate since the mortgage payment will make up a significant part of Pat’s cashflow. However, you can see that Pat’s assets carry him through his entire retirement in Scenario 2, whereas in Scenario 1 he needs a reverse mortgage to cover for his liquid asset shortfall.

While a reverse mortgage is better than Pat being forced to sell his home, it typically has mortgage rates that are roughly 4% higher than what he would’ve gotten on a regular mortgage. Pat is also limited in regards to how much he can take out. With a regular mortgage Pat can finance up to 80% of his property value, whereas with a reverse mortgage it is limited to 30-55% of his property value depending on the lender, his age and other factors. There’s also no guarantee that the product will exist in the future (it’s only offered by a handful of lenders), which could mean that Pat is left with only private lending options that then have rates that are roughly 10% higher than a regular mortgage.

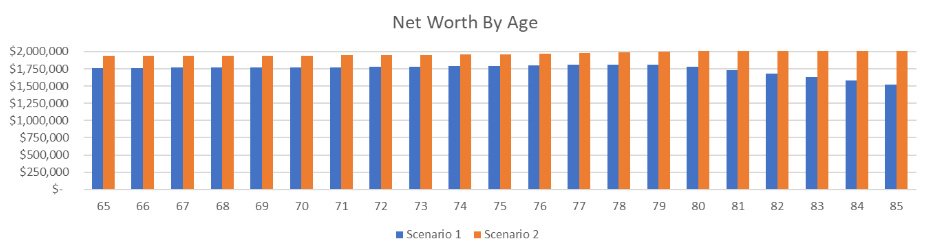

Borrowing at a higher rate then also starts to deplete Pat’s net worth over time. You can see that in Scenario 2, Pat’s net worth at 85 is $2,066,000 versus $1,520,000, roughly 36% more!

Why does investing matter so much?

There are two key factors at play here. First, owning a home doesn’t automatically let you access the home equity built up by paying off your mortgage or through house prices appreciating. Typically, the only time the value of your property is realized is when you sell your home.

We’ve all heard the term ‘home equity’ tossed around in conversations about homeownership, but unless you’re in the business of flipping properties or doing major renovations, you probably aren’t planning on using any home equity you’ve built up. Once you get pre-approved, refinancing lets you take full advantage of that home equity, without selling your home.

When we look at investment returns, they typically exceed today’s mortgage rates. This allows you to take advantage of two sources of returns: property prices appreciating, as well as the return on whatever you invest in. The impact of this difference is even larger if you use various tax-saving accounts, such as investing within an RRSP or TFSA, neither of which were utilized in our model. We’ve all heard of the power of compounding when it comes to interest and investment returns. This approach boosts your investing power even further.

Is the conventional wisdom of paying off your mortgage fast wrong?

Let’s be clear: both scenarios build wealth for retirement and homeownership is a powerful tool you can leverage. The conventional approach has its benefits too. Most people can appreciate the feeling of security that comes with paying off their mortgage and not having to manage it as part of their monthly budget. Conventional wisdom tells us that owning your home outright is the smart choice, and to many of us, it naturally feels like the safest option. What most of us may overlook is that a big portion of financial stability in retirement comes from investing more into your nest-egg and to ensure a higher income once you retire. Knowing that you won’t have enough assets to fund your retirement upfront is not a great feeling, even if you know that a reverse mortgage is a potential option.

Should I always choose to refinance and invest?

Disclaimer: we’ve built a model, not a crystal ball. We weren’t surprised to learn that investing, particularly when starting early, has a big impact on your financial health in retirement.

Conventional wisdom makes us think of ‘leverage’ as a dirty word. We commonly assume that refinancing your home is something people only do because of a desperate need for cash. The truth is that leverage is just a tool. Like any tool, it can be used correctly or otherwise. The reality of homeownership is that you’re already using leverage – your mortgage. What is clear from this exercise is that by ignoring your refinancing options, you may be trading the feeling of security today for a significant amount of retirement savings and income in the future. That being said, property prices don’t always go up and investments don’t always make money, so the correct decision is going to be somewhere in between.

Even if you don’t refinance, building in access to the equity in your home (ex: a mortgage that includes a home equity line of credit) while you have the ability to do so before you retire is a prudent decision. While this forgoes the compounded wealth benefits leading up until retirement, it does at least provide for a cheaper source of funding in retirement than a reverse mortgage and can enable you to leverage 65% of your property’s value instead of 40%.

What should I invest in?

The fundamental assumption for Scenario 2 to generate excess wealth in building up to retirement is that Pat must consistently make more on his investments than his mortgage rate. Furthermore, we assume Pat is responsible with his refinance proceeds and invests all of it. If Pat took that money and splurged on things like vacations, new cars, etc; then he is no longer building excess wealth and is in fact financing expenses which is a sure way to destroy net worth over time.

We want to reiterate that leveraged investing is not something that should be taken lightly and we strongly encourage our clients at Perch who are considering this strategy to consult their wealth advisor to determine what’s right for you. When increasing your mortgage to invest, there’s a few things to consider regarding the portfolio you invest in:

- Passive Income: Increasing your mortgage amount may result in higher mortgage payments. If your income hasn’t increased enough to sustain it, ensure that a portion of your investments have income generation (ex: dividends) that allow for passive income to offset the higher expenses to have cash flow be in a range you’re comfortable with.

- Liquidity: Leveraged investing can sometimes require a long time horizon as value may not always materialize immediately. Therefore, this typically is better suited for a property you intend to hold for the foreseeable future (3+ years) to avoid potentially needing to liquidate investments at inopportune times.

- Taxation: You may be able to take advantage of many things to lower your taxes and further increase your gains in Scenario 2 such as tax shelters (RRSP, TFSA, etc) or the ability to write off your mortgage interest for investments. These will be specific to each individual and you should consult your accountant or wealth advisor.

- Risk: The goal of leveraged investing is to earn a reasonable spread above your mortgage cost of financing where there is a reasonable degree of capital preservation. Consult your wealth advisor to see what portfolio makes sense and we strongly advise against high risk bets where the capital is at risk as you would then be stuck with a higher mortgage amount and nothing to show for it.

If you’re an existing homeowner, create a Perch profile to find out how much equity is available in your home.

Our mortgage advisors will help you plan your mortgage strategy to optimize how you use your home equity.

Alex

Alex