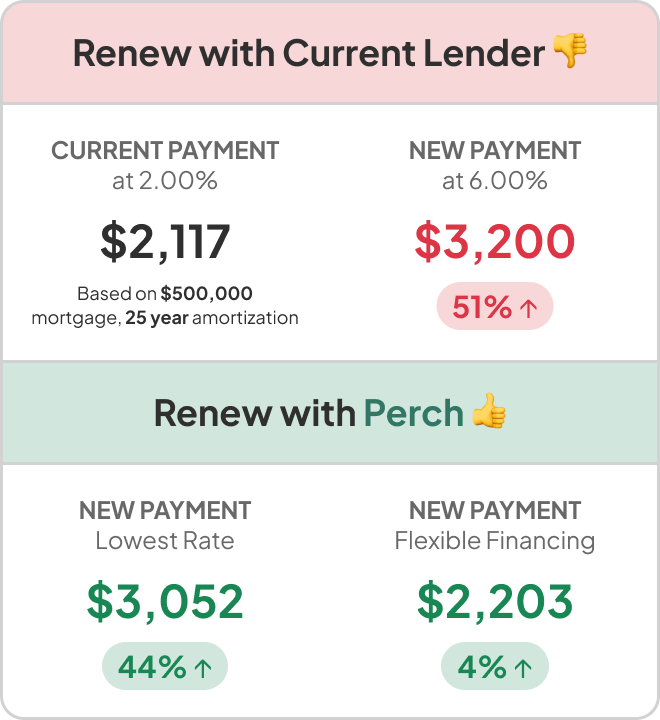

| Save money on your mortgage. Learn about what your payment could be at renewal and how you can save by renewing your mortgage with Perch. |

The Bank of Canada announced on January 29th that they will cut their policy interest rate by 25 bps which brings the current overnight rate to 3.00%.

Key Takeaways

- The Bank of Canada has cut their policy interest rate, which brings it to 3.00% as of their latest interest rate announcement

- The next interest rate announcement is on Wednesday, March 12, 2025.

- Talk to an experienced mortgage advisor to understand the announcement’s impact on your mortgage payment or upcoming renewal

Why did the Bank of Canada cut interest rates?

Commentary from Perch’s CEO and Principal Mortgage Broker, Alex Leduc:

The latest Bank of Canada interest rate announcement occurred on January 29, 2025. While the Canadian economy is showing moderate growth and core inflation figures hovered at 1.6% last month (below the 2% target), unemployment has continued to increase to 6.8%. The Bank of Canada has decided to cut rates further to avoid dragging the Canadian economy down further and fueling rising unemployment.

What does this mean for my mortgage with Perch?

- For variable rate mortgages (meaning your payments don’t fluctuate as prime rates change): Today’s decrease means that less of your existing mortgage payments go towards the interest portion of your mortgage as your amortization decreases, but your payments will stay the same. Use our Mortgage Renewal Calculator to get an estimation of what your expected rate and payment will be at your maturity date. If the payment isn’t manageable, connect with your advisor well in advance to look at all options.

- For adjustable rate mortgages (meaning your payments fluctuate as prime rates change): The latest cut will further decrease your mortgage payments and the outlook shows that a few more cuts from the Bank of Canada are expected throughout 2025 to further reduce your mortgage payments.

In the chart below, you can see how our 5-year variable rate forecast has changed over time based on the Bank of Canada’s interest rate announcements. (Like what you see? Sign up to get free, personalized mortgage insights and our monthly mortgage outlook!)

Spreads continue to compress on variable mortgage rates, which is eroding some of the benefit of the cuts to borrowers in favour of lenders Spreads as high as Prime-1.40% were common in 2021/2022, 3 months ago Prime-1.15% and today is only Prime-0.95%.Expectations are largely unchanged going forward relative to last month, except the long run normal rate has come down slightly by roughly 0.25%

Will mortgage rates go up in the next 5 years?

Based on our latest Mortgage Rate Outlook, expect 5-year variable mortgage rates to continue dropping in 2025. We’ll be updating our mortgage rate forecast after every Bank of Canada interest rate announcement – you can subscribe to our mortgage rate forecast for free.

Don’t miss the opportunity to boost your buying power by up to 50%

What is the Bank of Canada interest rate today?

The current Bank of Canada interest rate sits at 3.00%, with a 0.25% rate cut announced on January 29, 2025.

When is the next Bank of Canada interest rate announcement?

The next scheduled Bank of Canada interest rate announcement is Wednesday, March 12, 2025 at 9:45 AM ET.

What are the interest rate announcement dates in 2025?

There are a total of 8 Bank of Canada interest rate announcements each year. The dates for 2025 are as follows:

- Wednesday, January 29, 2025

- Wednesday, March 12, 2025

- Wednesday, April 16, 2025

- Wednesday, June 4, 2025

- Wednesday, July 30, 2025

- Wednesday, September 17, 2025

- Wednesday, October 29, 2025

- Wednesday, December 10, 2025

(Source: Bank of Canada)

The Bank of Canada typically makes their interest announcement at 9:45 AM Eastern Time.

Here’s what else we’re reading:

January Mortgage Outlook (4 min read time)

Fixed or Variable? How to choose the right mortgage for you (4 min read time)

Mortgage switch vs mortgage renewal (4 min read time)