Everything you need to know about an Agreement of Purchase and Sale in Ontario

When buying a home, there are many types of documents to be reviewed and signed as part of the purchase process.

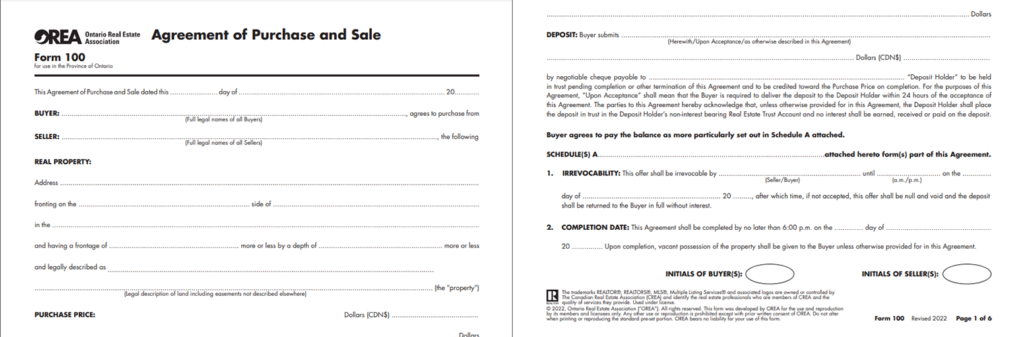

When purchasing a home in Canada you will need to sign an Agreement of Purchase and Sale, often referred to as a purchase agreement. In Ontario this document is mandated by the Ontario Real Estate Association..

We reached out to Matthew Prior of Royal LePage Realty Plus Oakville, Brokerage to take us through the key sections of an Agreement of Purchase and Sale document in Ontario. Matthew has been a realtor in the municipalities West of Toronto for nearly 12 years helping clients to purchase their home since 2015.

Source: Ontario Real Estate Association

What is a purchase agreement and why do you need one?

A purchase agreement is a contractual document between buyer and seller establishing the terms of an agreement, along with (possible) conditions & respective deadlines that must be met in order for the deal to become firm and binding. Often called “the offer,” it’s of utmost importance to have this document completed in its entirety with various clauses that protect both sides of the transaction, such that the lawyers can close the deal as agreed, on the specified completion date.

Who has to sign the purchase agreement?

All parties to the transaction are required to sign off on the paperwork, including the buyer(s), the seller(s) and the realtors. Every name that’s currently on title or that are going to be on the Agreement to Purchase will need to at minimum; initial/sign each page (and any changes that arise through negotiations, to signify they’re in agreement), along with a page signing under seal, and the final party to the negotiations will sign to establish that they’re “accepting” the offer within the prescribed irrevocable period (the time up until the offer can’t be revoked). The only exception to this would be in the event that a power of attorney (POA) or executor/trustee of an estate is managing the transaction on behalf of someone who is incapacitated or deceased. The realtors only need to sign in one spot establishing that all money is being exchanged in Trust, and as per MLS Rules & Regulations as part of a Commission Trust Agreement.

Do homebuyers have to fill out all the info?

No, the Realtor representing the buyer will prepare all the documentation, along with any respective Schedules to the transaction (where important conditions and supplementary clauses are included).

Do you need to read the whole agreement?

Yes, this is a contractual agreement and buyers must understand the paperwork that they’re signing. The majority of clauses are pre-drafted by Ontario Real Estate Association (OREA) lawyers, with plug and play spaces regarding particulars of the Agreement (Price, Closing Date, Irrevocable Date, etc.), but it’s important for buyers to understand the nuances of what they’re signing, so that there isn’t cause for confusion. The buyer’s realtor should be able to explain the clauses in simple terms, or provide OREA’s “Forms Explained” version which provides Coles Notes of the clauses.

Can a buyer or seller back out of this agreement after signing it?

Yes, and no – Conditions in an offer (usually lasting between 2-5 business days relating to Financing, Inspection, or Status Certificate review for condominiums) would be an example where a buyer could back out. In rare occurrences, either the buyer or seller may include a “Lawyer Review” condition which could provide them a reason to back out. That being said, if all conditions are fulfilled/met, then the Agreement is considered “firm,” and the deal will go ahead as planned. If one party defaults after this point, it would result in lawsuits to settle.

What are chattels fixtures and rental items?

Chattels are any items in a property that could be removed without the use of a tool (screwdriver, hammer, etc.), whereas a fixture is anything that is affixed to the property. The most common chattels would be kitchen and laundry appliances, which would be permitted to be removed from the property unless expressly stated in the contract.

That’s why, it’s of utmost importance to pay attention to what’s included/excluded in the offer, and best to specify when in doubt. One example of a chattel is when decorative bathroom mirrors are “hung” in place – a buyer may think it’s affixed, whereas the Seller knows they could just be easily lifted off.

An example of a fixture is a TV mount, since it’s screwed into the wall, but could usually be disconnected by twisting and lifting off the back of the mount. Rental items are exactly as described, and the seller would need to “buyout” any contracts prior to the closing date, unless the Buyer agrees to assume these monthly contract fees. Most often a water heater will be rented, though from time to time, the furnace, air conditioner or water softener may also be rented or have a “servicing contract” associated with it. These contracts can come with very big “buyout” amounts, sometimes in the tens of thousands of dollars.

What is the “title”?

In Ontario, “title” is the legal ownership of a property. In terms of the Agreement to Purchase, there are a few clauses pertaining to “title.” One of which is that for a cost, the buyer’s lawyer will undertake a “title search,” and any issues must be brought to the Seller’s lawyer’s attention within a designated timeline (usually approximately 2 weeks before closing). This is to assure that there’s no restrictions, liens or encumbrances on the property. Furthermore, the lawyer will confirm that you want to pay for “title insurance” which is a one-time payment/premium, which is highly recommended in the event that any situations arise over the term of you living at the property – one could be seen as small as a fence issue (if installed year’s prior by past owners) in not realizing where your property line actually lies, but could turn out to be a substantial claim, or alternatively should you be the victim of title fraud.

Is there anything else you should know when signing a purchase agreement?

Buyers should know that the deposit is to be delivered within 24 hours of an accepted offer. If a condition is not met by the seller this can be refunded; however, this deposit will be held until closing as a sign of good faith. In the event that the buyer satisfies their conditions and firms up the offer but doesn’t close, they will be liable for any and all damages, which could exceed their deposit.

Thank you to Matthew Prior for letting us use his expertise to answer these questions.

If you’re looking to buy a home in the Halton or Greater Toronto and Hamilton area, you can find Matthew at his website matthewprior.ca.

If you’re looking for the ability to shop mortgage rates and leverage our mortgage advisors expertise, sign up to Perch and you could be pre-approved on a mortgage today.