Is inflation slowing down in Canada?

You’ve likely noticed it, the cost of living has been increasing recently, and everything from groceries to mortgages have become more expensive due to inflation. Inflation reduces the purchasing power of our dollar and increases the cost of living.

The Bank of Canada has been trying to bring inflation back down to their target of 2% over the past year, but how effective has it been? Will they need more rate hikes to tame inflation or is it on the right track?

Key Takeaways

- The Consumer Price Index (CPI) is the primary measure we use to evaluate inflation.

- The Bank of Canada has a goal of keeping inflation in Canada at 2% or less per year.

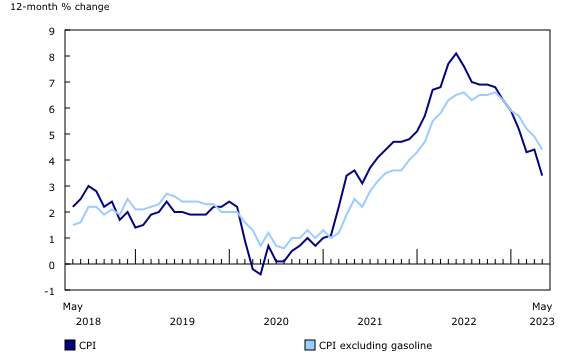

- As of May 2023 the CPI was increasing at 3.40% annually.

Let’s take a look at how inflation is trending in 2023.

What is the CPI?

The Consumer Price Index (CPI) is calculated by Statistics Canada and is used as a measure of inflation. The CPI is meant to measure a basket of typical goods and services that Canadians spend their money on, to get a ballpark figure for how prices are trending and how the cost of living is changing. The basket of goods that makes up the Consumer Price Index is weighted by sector and includes things like fuel costs, housing costs, the cost of groceries, electronics, and more. Not all elements of the CPI move in the same direction. For example, the price of gas fell over 18% from 2022 to 2023, while housing costs were up 4.7% largely due to an increase in mortgage rates.

What causes inflation?

The exact cause of inflation isn’t a science, but there are a number of factors that impact the value of our dollar. In general, the price of goods increases when demand outpaces the supply. When consumers increase their spending, for example due to an increase in disposable income, or to a reduced cost of borrowing, the cost of goods tends to go up. During the pandemic the Bank of Canada took a number of measures aimed at stimulating the economy which aimed to “increase spending in the economy” as per their website.

Another commonly cited driver of inflation is the monetary supply. When the supply of money goes up, each individual dollar loses its comparative value. In an extreme example, if everyone in the world suddenly gained a billion dollars out of thin air, the supply of goods would be the same but the price people would be willing to pay would skyrocket. People would race to buy goods at current prices with their massive windfall of cash and businesses would quickly raise prices to accommodate for this.

On the other side of the supply and demand equation, a sudden shock in the supply of goods could also cause prices to increase. The COVID-19 pandemic caused a number of supply chain shortages that many industries are still recovering from today.

With all of this in mind, it’s clear that the current high rate of inflation in Canada is a result of multiple factors, which makes finding a solution more tricky.

How does the Bank of Canada control inflation?

The Bank of Canada has a stated goal of keeping inflation under 2% per year. To control the economy, the Bank of Canada has a number of tools under their belt, but their main strategy for taming inflation is the raising of interest rates. In 2022, the Bank of Canada increased their policy interest rate seven times and so far they’ve increased it another two times in 2022 bringing the current key rate to 4.75% up from 0.25% in January of 2022.

The Bank of Canada looks at the CPI to determine if their policies are having the desired effect. Currently the Bank of Canada is trying to curb inflation by increasing interest rates. Higher interest rates mean a higher cost of borrowing and therefore decreased demand for things like mortgages. When interest rates are high, consumers are less likely to spend their money as debt is more expensive, and they can get a higher return through assets like bonds and GICs.

At the same time, increasing interest rates also increases mortgage costs which in the short term increases the cost of shelter in the CPI. As a result it can be difficult for the Bank of Canada to determine whether their policy is having the desired effect, or is worsening the cost of living for Canadians. This is partly why the Bank of Canada took a multiple month break earlier in 2023 to assess whether their rate hikes were enough to curb inflation.

Increasing interest rates also mean a slowdown of the economy as businesses face a higher cost of borrowing and tend to reduce business output leading to layoffs. While unemployment is not generally something for celebration, the bank of Canada has an increase in the unemployment rate as part of their goal. According to the Bank of Canada, the current high rate of employment is “not sustainable”, and is partly to blame for inflation due to the increased demand a high rate of employment generates.

Is inflation slowing down in 2023?

Following a rapid increase in the CPI during the pandemic, inflation has begun to slow following interest rate hikes from the Bank of Canada starting in 2022. As of May 2023 the CPI was up 3.40%, down from 4.40% in April. All of this paints the picture that the Bank of Canada’s policy is having the desired effect and inflation is trending in the right direction. Does this mean the rate hikes are over? Not necessarily, says our resident mortgage market expert Robert Malcolm. “While it is nice to see CPI (Consumer Price Index) drop to 3.4%, it doesn’t automatically mean that we will avoid an interest rate increase July 12.” said Rob on social media following the release of the latest CPI numbers in June.

If you’re an existing homeowner, sign-up to Perch and find out how much equity you have access to today. If you’re in the market for a mortgage, you can be pre-approved in as little as 20 minutes when you sign-up to Perch.

Alex

Alex