Advance polls open October 11th and up until October 15th you can cast your vote in the federal election. To nobody’s surprise, affordable housing is top of mind and we wanted to outline how we believe each party’s housing policies are going to affect you as a first-time homebuyer.

Disclaimer: Perch isn’t advocating for any particular party. We’re just speculating on possible outcomes using our tools and analytics.

As mentioned in our Guide to Buying a Home, your ability to buy a home is based on if you have the minimum down payment and pass the stress test.

What is the stress test?

Mortgage stress tests are rules laid out by the government/regulators that dictate how much someone can borrow. There are 2 main ratios, the Gross-Debt-Servicing (GDS) and Total-Debt-Servicing (TDS) ratios.

Learn more about this in our Guide to Buying a Home.

Here’s a summary of each party’s policies that would potentially affect you as a first-time homebuyer:

|

|

|

|

|

|

|

|

How does this affect first-time home buyers?

MEET ALI.

Ali is a first-time buyer. He has a gross income of $85,000 and he’s saved up a down payment of $50,000. Ali used Perch to pre-qualify for a mortgage rate of 2.47% (our insured 5-year fixed rate at the time this was written).

Under today’s regulations, the highest property price that Ali would qualify for is $440,000 and his mortgage payment would be $1,800 per month.

Here’s how each policy will affect Ali

Increasing The Amortization Period

Affordability

A higher amortization period means a lower mortgage payment, which increases the max purchase price in the stress test calculations. Note that this only applies to someone putting down less than a 20% down payment because anyone putting down 20% or more can already qualify using a 30-year amortization.

New Qualifying Purchase Price for Ali: $475,000 (+8%)

Cost

If you increase the amount of years to pay off your mortgage it means your mortgage payment will be lower. However, a higher amortization also means that you will pay more interest over the life of your mortgage if you don’t make any mortgage prepayments.

New Mortgage Payment for Ali: $1,584 (-$216)

Extra Interest Paid Over 30 Years (assuming no prepayments): $30,255

Caveats

The above calculations assume that everything stays constant, but it’s doubtful that this would be the reality. If everyone suddenly got an 8% affordability boost, it’s likely that home prices would go up and a portion of your affordability gains would go to the seller because you’d be paying more for the same property. If you buy the same $440,000 home for $475,000, your mortgage payments would then be the same as they would’ve been with a 25-year amortization, except now you will be stuck paying more interest over the life of your mortgage.

Building More Homes

Simple economics would dictate that if you increase the supply of something, the price for it should decrease. However, the materiality of that decrease depends on how much you increase supply. It’s worth mentioning that in 2016 there was an estimated 14.1MM households in Canada.

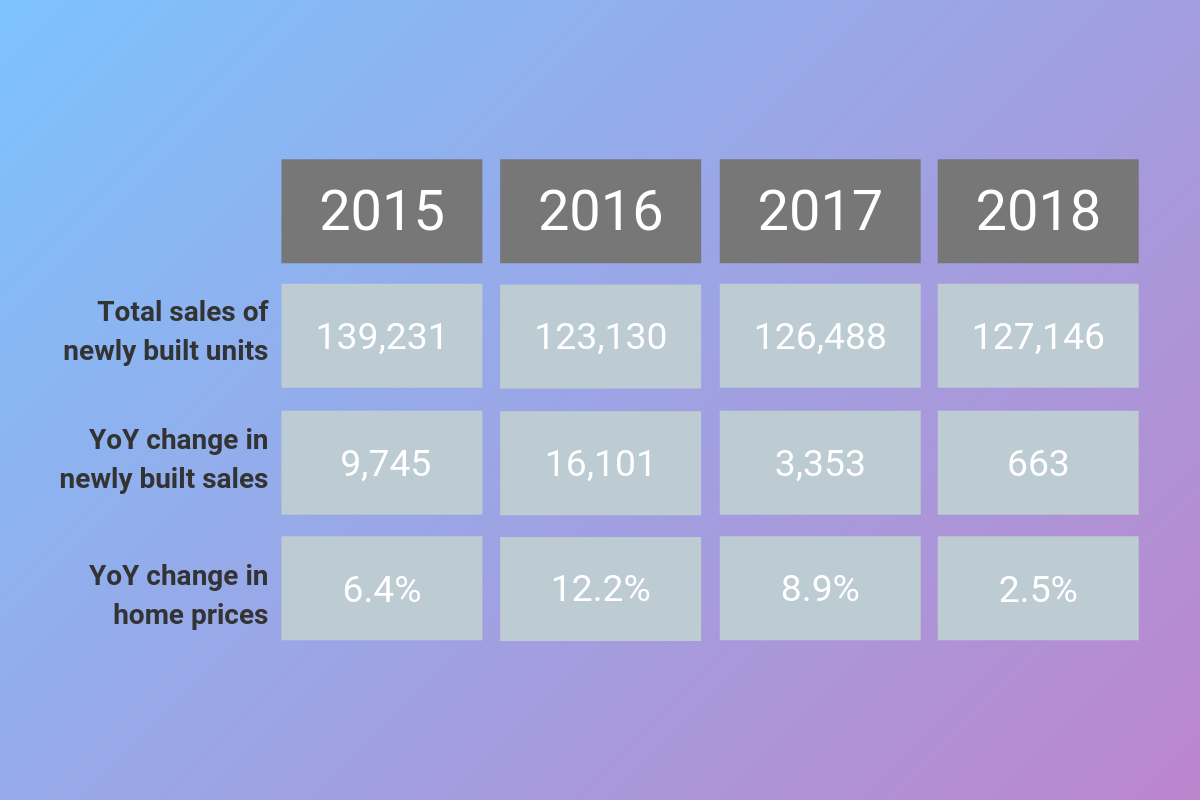

Using CMHC new build figures and Teranet Home Price Indexes, we can see above that the proposed changes in new housing stock (25,000-50,000 units per year) would be large by recent standards. However, as we have seen in the past, increases in housing stock don’t always result in lower home price growth.

Affordability/Cost

The increase in housing supply would likely slow the pace of price appreciation but it’s unlikely that the government would want to bring in a program that would shock market enough to lower home prices. Furthermore, these homes would take 2+ years to start hitting the market, so the impact in the near future will be minimal.

Caveats

Using the last 4 years of data is only meant to serve as a quick point of reference, since there would be thousands of other variables that could’ve influenced the HPI outcome (ex: population growth). It’s just meant to illustrate that housing supply increases don’t guarantee lower home prices. This also assumes that the government would be able to build the promised number of units on time, but actual results may vary.

Eliminate The First-time Home Buyer Grant

When you file your taxes as a first-time home buyer, you get around $750 back through tax credits. The Green party would eliminate this grant. This has no impact to your affordability.

Expand The FTHBI to Certain Cities

Under it’s current structure, the First-time Home Buyer Incentive (FTHBI) reduces people’s purchasing power by about 10%. We discuss the incentive in more detail here.

Affordability

Unless you live in the Greater Toronto area, Greater Vancouver area or Greater Victoria area your affordability would be lower if you used the FTHBI. However, if you live in one of the specific areas listed previously, you could qualify for a more expensive home under the expanded program.

New Qualifying Purchase Price for Ali in one of the selected cities: $475,000 (+8%)

Cost

The FTHBI can be used to top up your down payment and this lowers your mortgage balance. However, those mortgage savings don’t come for free. The FTHBI effectively makes the government a part-owner in your home (they have an equity stake equivalent to the 5 or 10% incentive amount you take) and will share in the price gains/losses of your home in the future. Our FTHBI calculator lets you assess what that might be.

BUT ARE THESE PROPOSED MEASURES SOLVING THE PROBLEM FIRST-TIME HOMEBUYERS FACE?

According to the 2019 Home Buyers Report (Mortgage Professionals Canada), around 50% of first-time home buyers purchased their home with a down payment of 20% or more, which means a 30-year amortization or the FTHBI would do nothing for them. Furthermore, none of these measures help Canadians that don’t have the required down payment.

The increased supply of housing is intended to help slow the pace of house price growth, but wouldn’t help anyone get into the housing market for at least a few years and it’s up for debate how much price growth would slow down as a result of the increased housing units.

Increasing the amortization for insured mortgages to 30 years will only impact those that plan on putting down less than 20% down payment and provides a marginal increase in affordability. Utilizing data from our Qualifier Tool (which people use to estimate if they qualify for their target property), we analyzed a random sample of 1,000 people and found that only 5% of people who previously didn’t qualify for their target property would now qualify with a 30-year amortization for insured mortgages.

So if you’re looking to get into the housing market in the next few years and these policies are unlikely to do much in the near future, what’s the best way for you to get into your first home?

A home buying plan. Getting your first home is a lot more complicated today than it used to be. We can help you set a realistic target and give you a free plan to achieve it. You can put one together with one of our mortgage experts or automatically through your Perch profile by clicking the button below.

Alex

Alex