First-time buyers and those with non-salaried income are underserved by traditional mortgage products.

Sharon*, a first-time home buyer, was locked out of the housing market.

She had saved $50,000, enough for a 10% down payment on a $500,000 property. However, the $121,000 pre-approval issued by her bank was too low to buy anything. Faced with these affordability issues, she felt daunted at the prospect of being a lifelong renter.

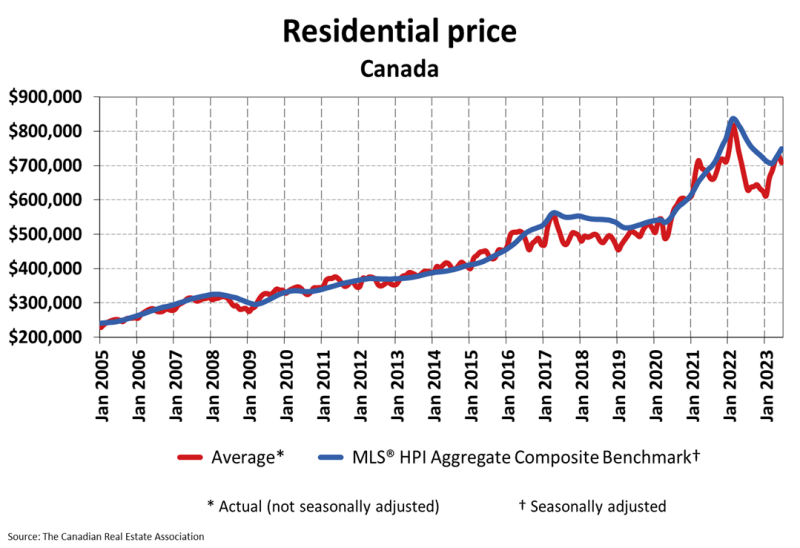

Average home price in Canada 2005-2023

Perch, a digital mortgage advisor, helps buyers like Sharon unblock financing challenges and gain access to the real estate market sooner. By identifying solutions to increase purchasing power, borrowers can typically qualify for 50% more compared to going with their bank.

Banks are trying to fit all Canadians in the same credit box

As mortgage rates increase and lender qualifying standards become stricter, fewer Canadians are able to qualify for a mortgage. In 2023, more than 35% of banks tightened household mortgage lending standards in the first quarter.

The Office of the Superintendent of Financial Institutions (OSFI) recently proposed stricter capital requirements for banks and mortgage insurers to manage mortgage risk, which will reduce their appetite to lend even further.

As a result, common sense underwriting policies to evaluate credit risk have transformed into a rigid box ticking exercise. The largest lenders seek borrowers who fit a narrow set of criteria and reject everyone else.

This affects everyone from home buyers who pursued higher education and are early in their career with high earning potential, small business owners and entrepreneurs with multiple income sources, or those who worked in industries heavily impacted by COVID and are still being penalized from its effects years ago.

Borrowers viewed as anything ‘less than ideal’ are rejected

To mitigate the perceived risk of default, lenders seek buyers that hold a full-time, permanent position with a large and stable Canadian employer; have an excellent credit score and little to no debts.

“For anyone who falls outside of the less than ideal profile, financing solutions are limited and/or expensive,” says Alex Leduc, CEO of Perch. “The traditional loan process excludes many consumers, restricting housing access to a select few.”

Other industry challenges include a lack of transparency

With thousands of mortgage products across hundreds of lenders, buyers can find it difficult to compare and find the best option for their situation. Mortgage applications are often handled manually. This leads to processing delays and a lack of communication between the mortgage advisor and borrower.

The lack of transparency, along with difficulty in finding the right mortgage advisor to work with can lead to decisions that negatively impact a borrower’s finances for years.

Auto-adjudication technology saves time, increases affordable financing options

The average mortgage advisor will either offer mortgage products from a single lender (for example, if they work for a bank), or a subset of 4 to 6 lenders, working as a mortgage broker. The borrower is then qualified based on a financial snapshot of their current circumstances.

Perch analyzes thousands of mortgage options from over 30 lenders in under 10 seconds. In addition, we help the borrower understand what they can do to improve their options today and map out the most effective path forward.

By automating over 65% of the mortgage advisor’s role, Perch empowers users to complete most of their mortgage journey in real-time and access more affordable financing solutions.

Financing innovation unblocks access to housing

Perch’s self-serve mortgage platform, paired with a dedicated mortgage advisor, quickly identified a path forward for future homeowner Sharon.

After paying down debt, Sharon increased her credit score from 580 to 630. Perch was able to pre-approve her for an amount 4x higher than her bank, along with a mortgage rate 0.60% lower than with a prime lender.

The lower mortgage rate saved Sharon $200 per month in mortgage interest, allowing her to enter the real estate market while continuing to build up her emergency fund.

About Perch

Perch is your digital mortgage advisor with superpowers, helping Canadians make data-driven decisions. We get buyers into the market sooner and enable homeowners to build wealth through real estate.

Perch previously announced its $4M Series A in October 2022, counting Second Century Ventures, the strategic venture arm of the National Association of REALTORS®, among its investors.