Hamilton, Ontario real estate market outlook 2023

We sat down with our realtor partner Steve Roblin to give us an outlook on the Hamilton real estate market for 2023.

You can find Steve on his website Steveroblin.com

How has the Hamilton real estate market done in 2022?

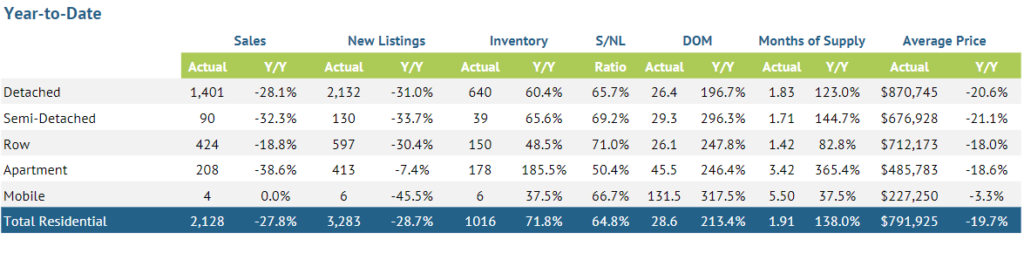

Over the last year, the Hamilton real estate market experienced a period of adjustment due to the Bank of Canada’s decision to raise interest rates multiple times. This led to a decrease in both the average sale price and demand for real estate. Sellers had to lower their asking prices to attract buyers, who were waiting for prices to stabilize around the historical trend line. Recently, the market has shown signs of recovery, with new listings selling consistently and the market beginning to balance out.

How has the market responded to the rate hikes from the Bank of Canada?

The real estate market initially reacted negatively to the rate hikes from the Bank of Canada, with reduced demand and lower average sale prices. However, the Bank’s recent decision to hold the rate has been a welcome announcement. The market has since started to stabilize, with buyers gaining confidence and showing a renewed interest in purchasing homes.

What factors do you see impacting the market?

Two words: Government intervention.

One of two options could happen moving forward in response to this potentially active Spring Market: Either the Bank of Canada raises the interest rates again and/or implements further lending restrictions and rules to slow down the market. Or the Bank of Canada says “okay great, inflation is down, economy is moving again, lets lower the rates in 2024.”

I do not anticipate the Bank of Canada raising interest rates again anytime soon. And while they might not lower them immediately, I do think we will see them continue to stabilize.

Where do you see the market going in the future?

The future of the Hamilton real estate market appears optimistic, with pending sales starting to overtake new listings. Prices are expected to remain stable throughout 2023, with a forecasted increase of 10.2% in 2024 (according to CREA). As the market continues to balance out, both buyers and sellers are becoming more acclimatized, leading to increased sales and a gradual return of multiple offers on properties.

Buyers are Ready

After the long correction where Buyers sat back and watched prices free fall over the past 10 months, the market has stabilized and they are ready to buy.

Buyers have seen new listings come up and sell straight away over the past few weeks, often in competition. This further adds confidence to eager Buyers, that the time is now.

Buyers are ready, they are approved, they know what they want; however there are very limited active listings out there.

Sellers are optimistic that average days on the market will continue to drop.

Down to an average of 27.6 days to sell in March 2023 from 31.2 days in February from 37.8 days in January. And April is already feeling much lower.

What advice would you give to someone thinking about buying in Hamilton?

For potential buyers in Hamilton, now is a great time to enter the market, as it has stabilized and seller confidence is rising. Buyers should be aware that multiple offers on properties are making a comeback, but properties are still selling for reasonable prices. You need to be prepared and have a clear understanding of what you want because there are limited active listings available.

With National sales more or less stable since the summer, this suggests that the downward adjustment on sales volume and average sale price as a result of the rising interest rates may be behind us.

Yes, it is still difficult for first time home buyers and even gainfully employed couples to afford some of these prices but some buyers are going to start to come off the sidelines as confidence that rates have topped out starts to spread.

As our market began to balance out over the past few weeks both Buyers & Sellers are becoming more acclimatized and sales are increasing.

Home sales have been increasing over the past few weeks as Buyer confidence in our market is rising.

Thanks to Steve for answering these questions and giving us insight into the Hamilton market.

Check out our interest rate forecast for an up to date outlook on the mortgage market, including where our analysts predict rates will go over the next 5 years.